BASE: Japan's "All-In-One" Shopify, Etsy & Stripe

With Q220 aggregate GMV & sales increasing by 133% & 177%, respectively, & its valuation up ~9x since March 2020, this "gem" has been discovered...though is the best yet to come?

In this post, we loosely translate & summarize publicly listed BASE, Inc’s business overview & Q2 2020 earnings presentation by Tsuruoka san (CEO), Harada san (CFO) & Yamamura san (COO). In some instances, we have taken the liberty to add additional details to provide further clarity & insights, while also excluding certain aspects of the presentation that were deemed less relevant for purposes of this post.

With its total gross merchandise value (“GMV”) up 133% YoY during Q2 2020, BASE has clearly benefited from the accelerated digitization brought about by COVID-19. Investors have taken note, with BASE today valued at ~$1.7Bn (up from ~$200M in March 2020), or ~18x NTM revenue & ~1.1x NTM GMV (both on an estimated “normalized new-normal” basis). Its arguably “fair” current valuation aside, a closer look at BASE’s business & product offerings reveals a company poised to exponentially power the ongoing growth & success of the emerging ranks of individual & small business “creators”, an important demographic building the increasingly digital backbone of the Japanese economy.

———

Business Summary

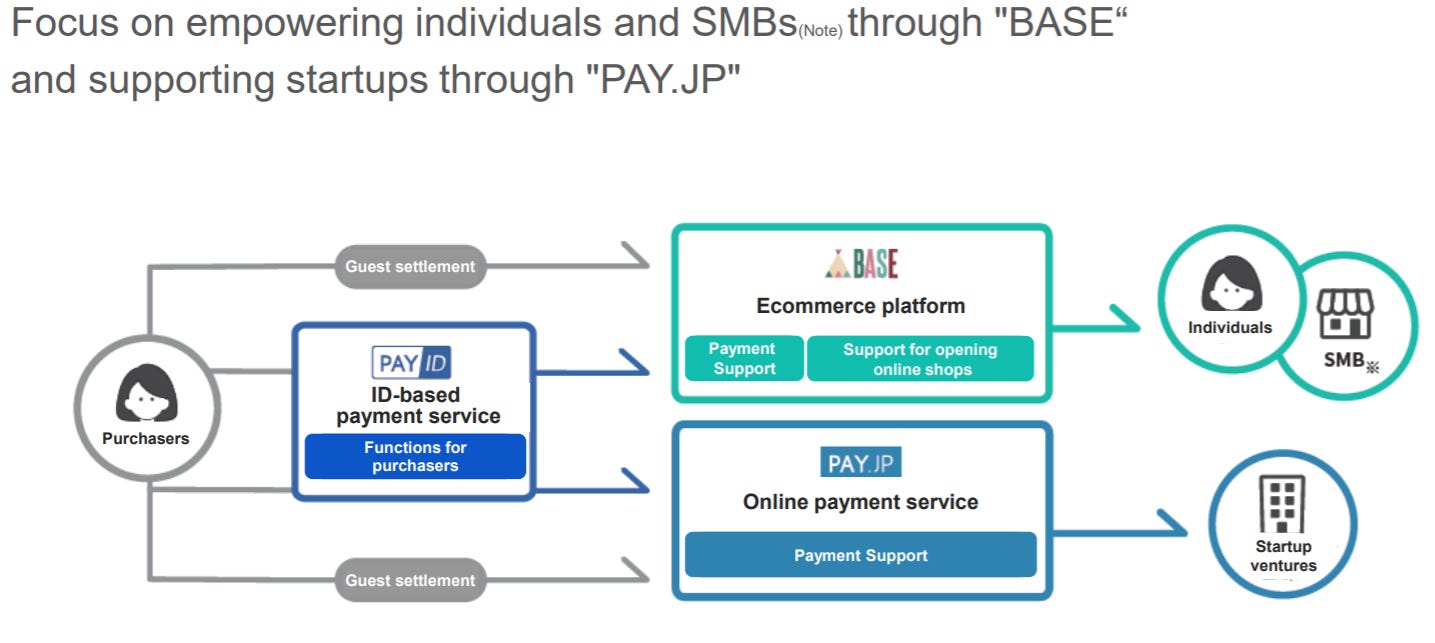

BASE, Inc. has three main businesses:

The company’s core offering since its 2012 founding is its namesake BASE business. In using BASE, merchants are able to seamlessly set up online storefronts, including all necessary digital payment capabilities. This “two-in-one” offering is a powerful competitive differentiation in the Japanese market.

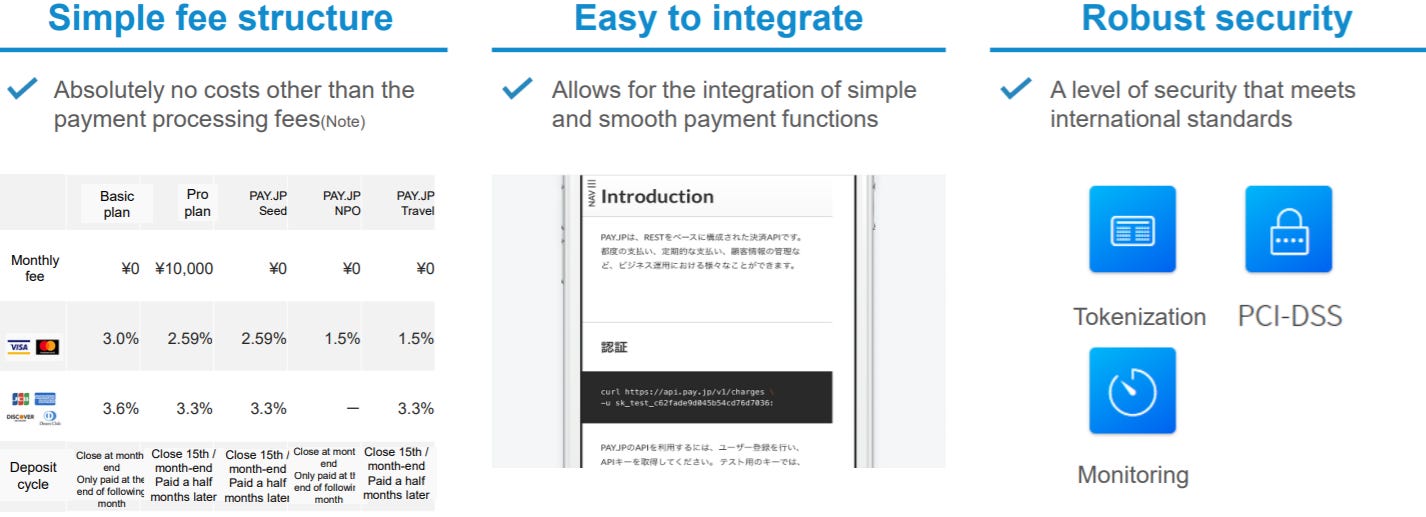

PAY.JP is the company’s above mentioned payment functionalities, though offered independently, without the added e-commerce capabilities. This API based product is best suited for digital-native companies, such as tech startups. This business was originally called Pureca & was acquired by BASE in early 2015. To be clear, there is no customer overlap between those using BASE & those using PAY.JP.

![HowTo]Pay.jpを用いたクレジットカードの登録機能実装について/カスタムフォーム版 - Qiita HowTo]Pay.jpを用いたクレジットカードの登録機能実装について/カスタムフォーム版 - Qiita](https://substackcdn.com/image/fetch/$s_!wyPG!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F652e861e-d904-4c79-bb40-cce64317c94a_1368x476.png)

BASE’s third line of business is PAY ID. PAY ID is specifically focused on end-consumers, who use this product to quickly & easily buy goods & services at the more than 1.1M BASE shops - be they digital or brick-and-mortar - without needing to re-enter payment information or swipe their credit card.

Seamless Set-Up & Launch of Digital Storefronts

BASE digital storefronts are free to set up, launch & maintain, however, all merchants must use Base Easy Payment (a.k.a. PAY.JP outside the BASE e-commerce offering). As a result, virtually all of BASE’s revenue today is derived from the payment processing + service fees it charges against its customers’ aggregate GMV. At the moment, this fee is 6.6% of the net transaction amount + ¥40 per transaction. Merchants can immediately offer any or all of the following payment methods:

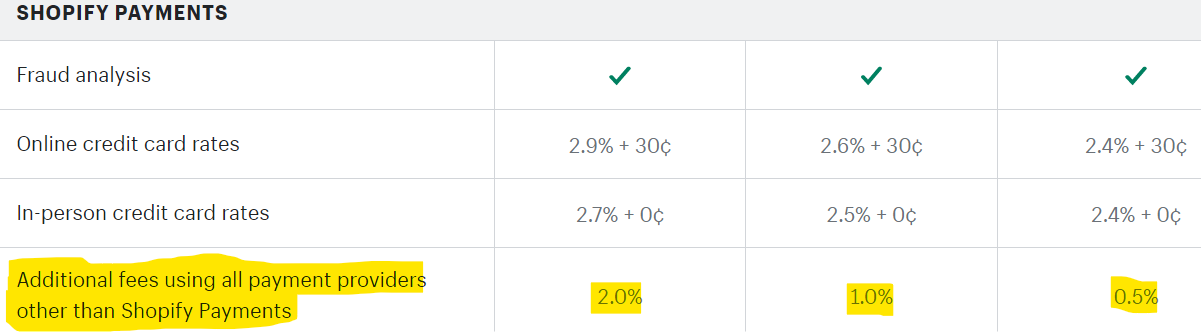

JBI note: Interestingly, BASE’s well-known global peer & Japan market competitor, Shopify, does not explicitly require merchants to use their in-house Shopify Payments product (yet). Unlike BASE, Shopify charges not only a monthly subscription fee, but also a transaction fee on top of typical payment processing fees for those merchants unwilling or unable to use Shopify Payments.

For Q2 2020, ~45% of Shopify’s GMV was processed through its own payment gateway. We expect this percentage to grow over time for Shopify & view BASE’s required use of BASE Easy Payment from the get-go as partly an at-launch necessary market reality, though also a wise long-term strategic decision. Ultimately, the more that BASE can become a one-stop hub for their merchants’ every need, the stronger the lock-in & the longer + larger the customer lifetime value.

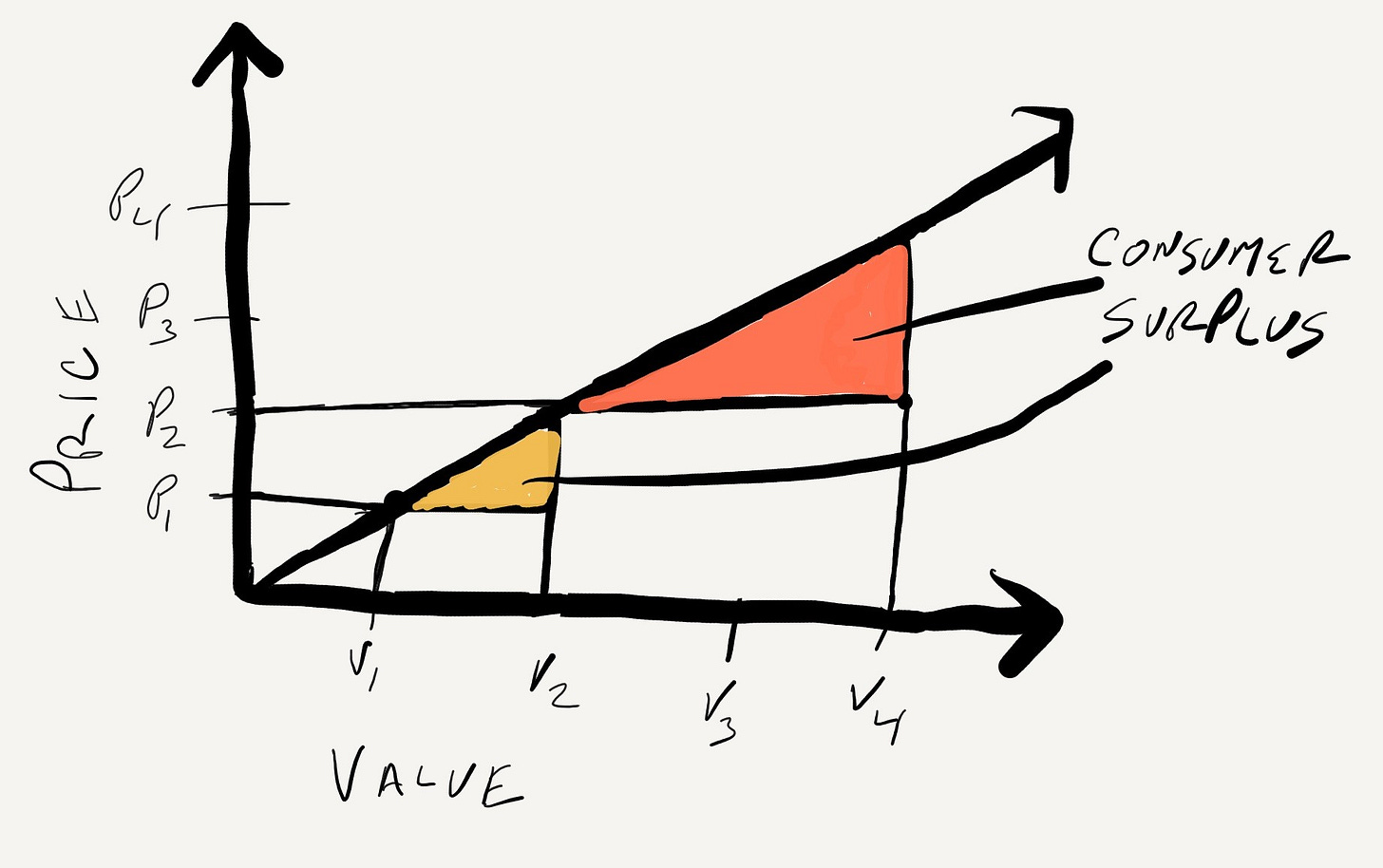

To expound on this point some, in what should likely evolve into a winner-takes-most market, at least as it relates to BASE’s targeted individual & small business merchant “creators”, BASE should be seeking today to aggressively grow their “merchant surplus” first (& as fast as possible) and their revenue second, in our view. It is a common refrain among investors to cite pricing power or pricing levers in thinking about future growth & profitability of a company. However, we’d strongly argue the ability to willingly - and sustainably over a meaningful time period - under-price or to even drop pricing when playing in a large winner-takes-most or winner-takes-all market is the most prudent course of action with the long-term in mind. We are specifically not referring to such a strategy when fueled by expensive venture capital, but rather when a proven business can internally finance and / or intelligently tap (accommodating) capital markets to do so. Two well known established companies who have created a tremendous amount of consumer surplus include Netflix & Amazon.

More to the point, as a home-grown domestic market leader, we would like to see BASE aggressively capitalize on its advantaged position by heavily investing in both net-new merchant sign ups as well as in rapidly broadening its ancillary product offerings. Once “at scale”, this subsequent business model “defensibility” - which is in part reflexively powered by its growing “merchant surplus” - should leave BASE with a firmly dominant market position & the ability to confidently flex pricing across its various value-add, revenue generating products to arrive at a higher “steady-state” margin profile.

With that said, we do think BASE is generally on this path.

While the Shopify comparison is relatively obvious, less so, but just as importantly, is that of BASE with Etsy, the vibrant U.S. e-commerce platform built primarily for the long-tail of individual “creators”. Empowering this growing “creative class” of “solo-preneurs” has proven to be a boon for Etsy. BASE appears to be on a similar trajectory & could arguably lean even more in this direction, while offering a personalizable, truly “creator-first” platform.

JBI note: while not often associated with the Japan of today, we are of the strong view that the collective entrepreneurial spirit that drove the Japanese economy post WWII & through the 1980’s will begin to more prominently re-emerge & flourish over the coming decades - in large part due to precisely the technologies BASE itself is creating…those that help to minimize the “barriers to creation” & provide new, low-risk avenues for experimentation & growth.

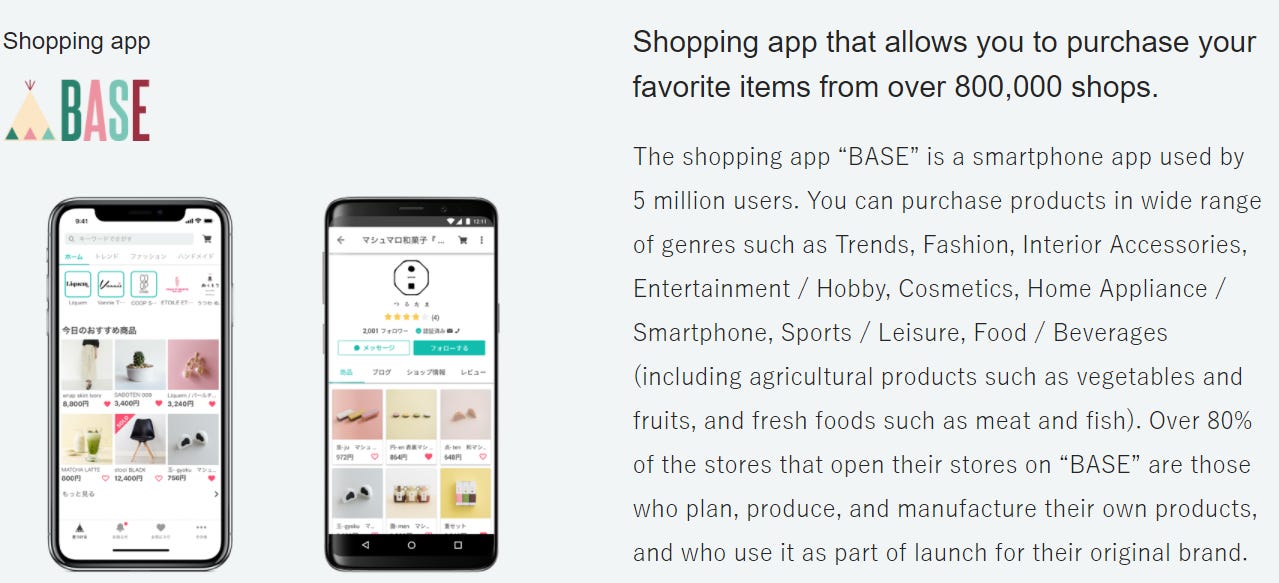

While not a primary demand aggregator like Etsy (i.e. BASE merchants drive their own store traffic, though BASE does act as a “partial” demand aggregator with its 5M user strong BASE store - see below image), the following company-sponsored survey statistics regarding BASE store owners lends credence to the general comparison with Etsy:

73% of BASE e-commerce shops are owned by individuals (not a corporate entity)

72% are digital-only storefronts (they have no brick-&-mortar presence)

75% sell what they deem to be entirely original, proprietary products

61% note their primary rationale for opening a BASE store is to “put forth what they create into the world”

A “Stripe-esque” Stand-Alone Payment Product

As mentioned, PAY.JP is BASE’s online payment solution simply offered without the added e-commerce functionalities. PAY.JP is primarily designed for companies requiring a high-quality, scalable & easy-to-use digital payment tool for their online activities. Like Stripe, PAY.JP caters mostly to digital technology companies. Current PAY.JP customers include:

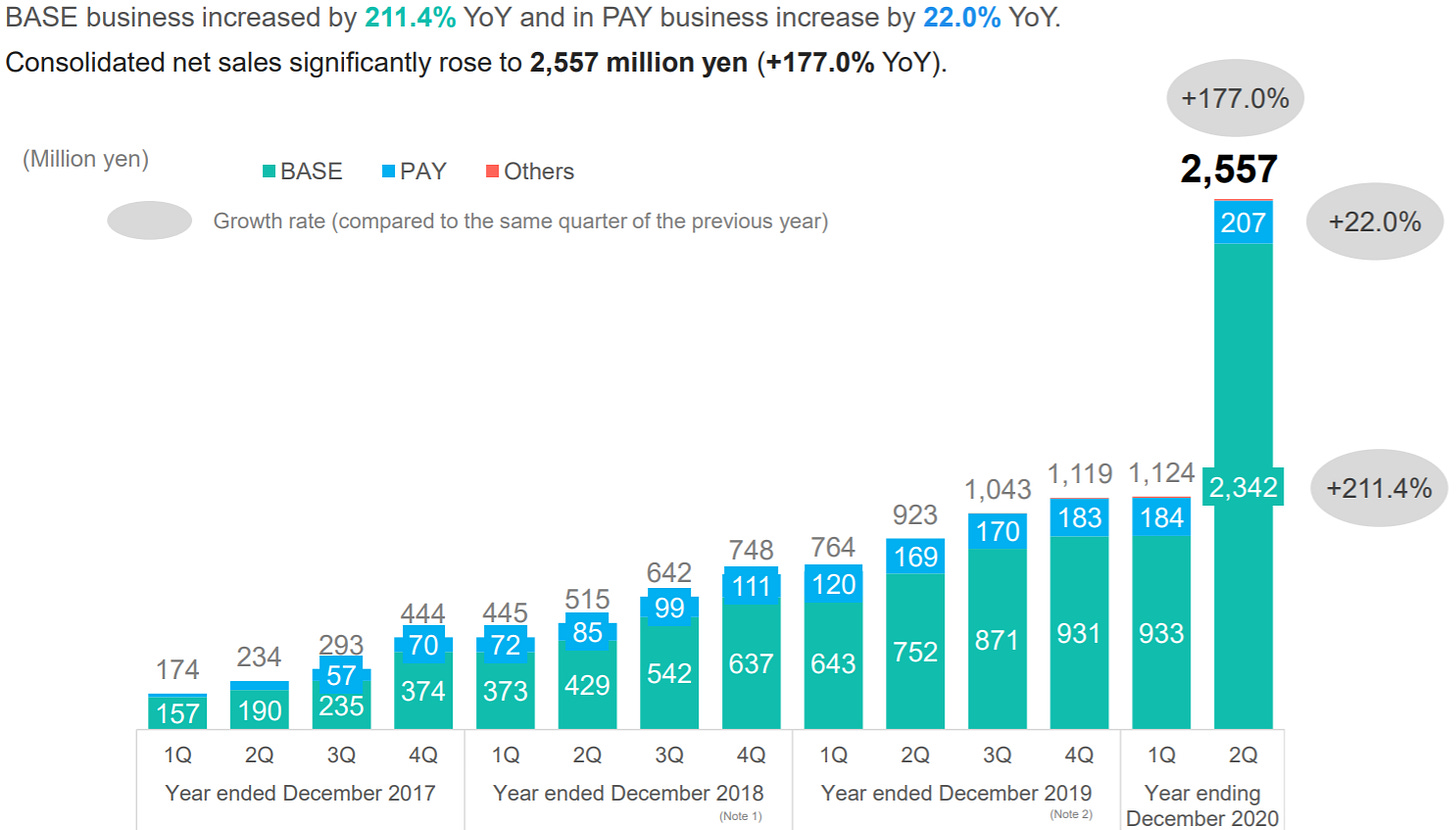

A Record Setting Q2 2020 For Both GMV & Sales

GMV

Sales

While the most recent quarter’s growth was explosive, it is important to note that BASE was still scaling at >45% YoY in recent pre-COVID quarters - quite strong.

Given the current market realities, the company has revised its full-year forecast with net sales now estimated to be ¥7.52Bn (~$71M) to ¥8.1Bn (~$77M), or up 95% to 110% YoY, while GMV (on an aggregate payments, not orders, basis) is expected to hit ¥122.5Bn (~$1.15Bn) at the top end of the range, or up 102%.

GMV Growth Largely Driven By New Sign-Ups

JBI note: it is worth noting the effective flat-line growth in GMV among earlier cohorts of BASE shops up until Q220. This opens up questions around churn, net retention & the like - data we don’t believe BASE discloses today. The second set of charts immediately above do provide some additional context, though not to the fullest extent we’d hope for. We would imagine (& as management has previously alluded to) that some meaningful minority of merchants represent & drive much of the GMV growth across each historical cohort, with the remaining majority likely with flat-line / declining sales or simply churning off - thus, the roughly flat-lined cohort-level GMV growth. That said, we’d turn again to Shopify to calibrate our expectations here & quote Ben Thompson of Stratechery in this regard:

“Many [shops], to be sure, will fail at this: Shopify does not break out merchant churn specifically, but it is almost certainly extremely high.

That, though, is the point.

Unlike Walmart, currently weighing whether to spend additional billions after the billions it has already spent trying to attack Amazon head-on, with a binary outcome of success or failure, Shopify is massively diversified. That is the beauty of being a platform: you succeed (or fail) in the aggregate.

To that end, I would argue that for Shopify a high churn rate is just as much a positive signal as it is a negative one: the easier it is to start an e-commerce business on the platform, the more failures there will be. And, at the same time, the greater likelihood there will be of capturing and supporting successes.”

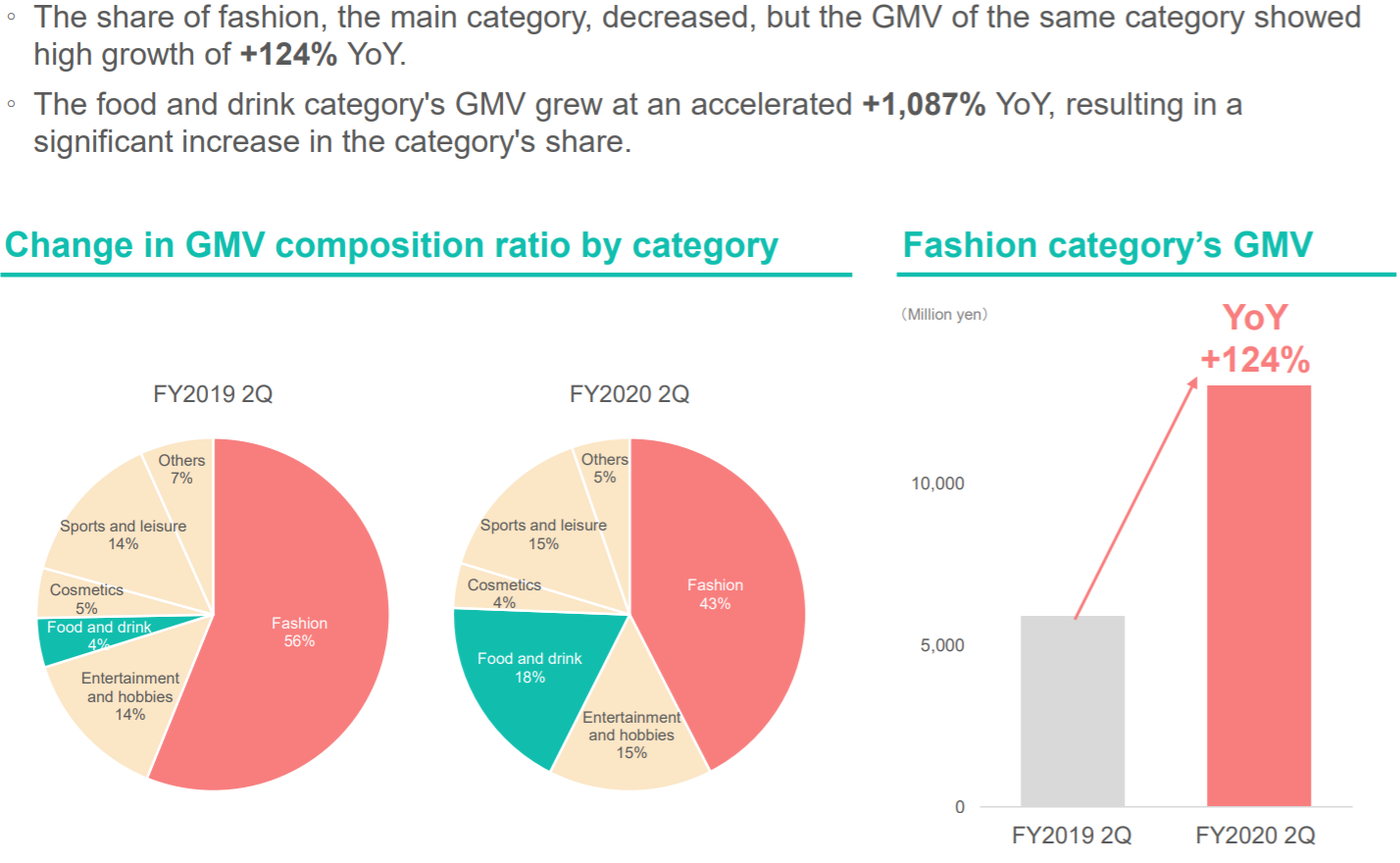

COVID Impacted GMV Composition, With Core Fashion Segment Benefiting Most

Some other relevant statistics to accompany the above:

The # of BASE shops in Q220 increased by 229% YoY & up 159% QoQ

The total # of BASE shops was greater than 1.1M as of July 2020

11% of Q220 GMV was COVID related hygiene products

Food & drink related GMV was by up 1,087%, representing 18% of total GMV. Notably, this was primarily driven by restaurant take-out orders.

A Surprisingly Steady “Take-Rate”

To reiterate, BASE’s “take-rate” is based on the total GMV flowing through their in-house payment tool in both its core e-commerce & stand-alone payment offerings. Recall that all BASE digital stores are required to use BASE Easy Payment.

JBI note: as we’ve touched on earlier, we believe BASE should explore increasing its implicit “take-rate” not necessarily through direct price increases within its existing offerings (as it did in 2017), but rather via the introduction of a growing suite of ancillary, value-add SaaS-like merchant tools (i.e. data analytics, etc.) and other relevant financial products, such as short-term merchant loans, business bank accounts, etc.

Beyond just further entrenching merchants within the BASE ecosystem, introducing such “add-ons” elongates & grows customer LTVs at what is effectively a zero CAC (i.e. the merchant is already a “captive” customer). With increased scale, this should help improve the company’s margins, bolster its operating leverage & further diversify its revenue. Fortunately, BASE is already starting down this path…

Supporting Merchants With Growth Capital

In a sentence, BASE leverages its merchants’ sales data to offer merchant cash advances (at 1% to 15% discounts against future sales) via its Yell Bank unit. This offering is similar to both Shopify Capital & Square Capital. This business remains in the relative early stages today, but is worth keeping an eye on, as such an offering likely proves very attractive & highly valuable among merchants who are used to dealing with generally very conservative, slow-moving Japanese banks.

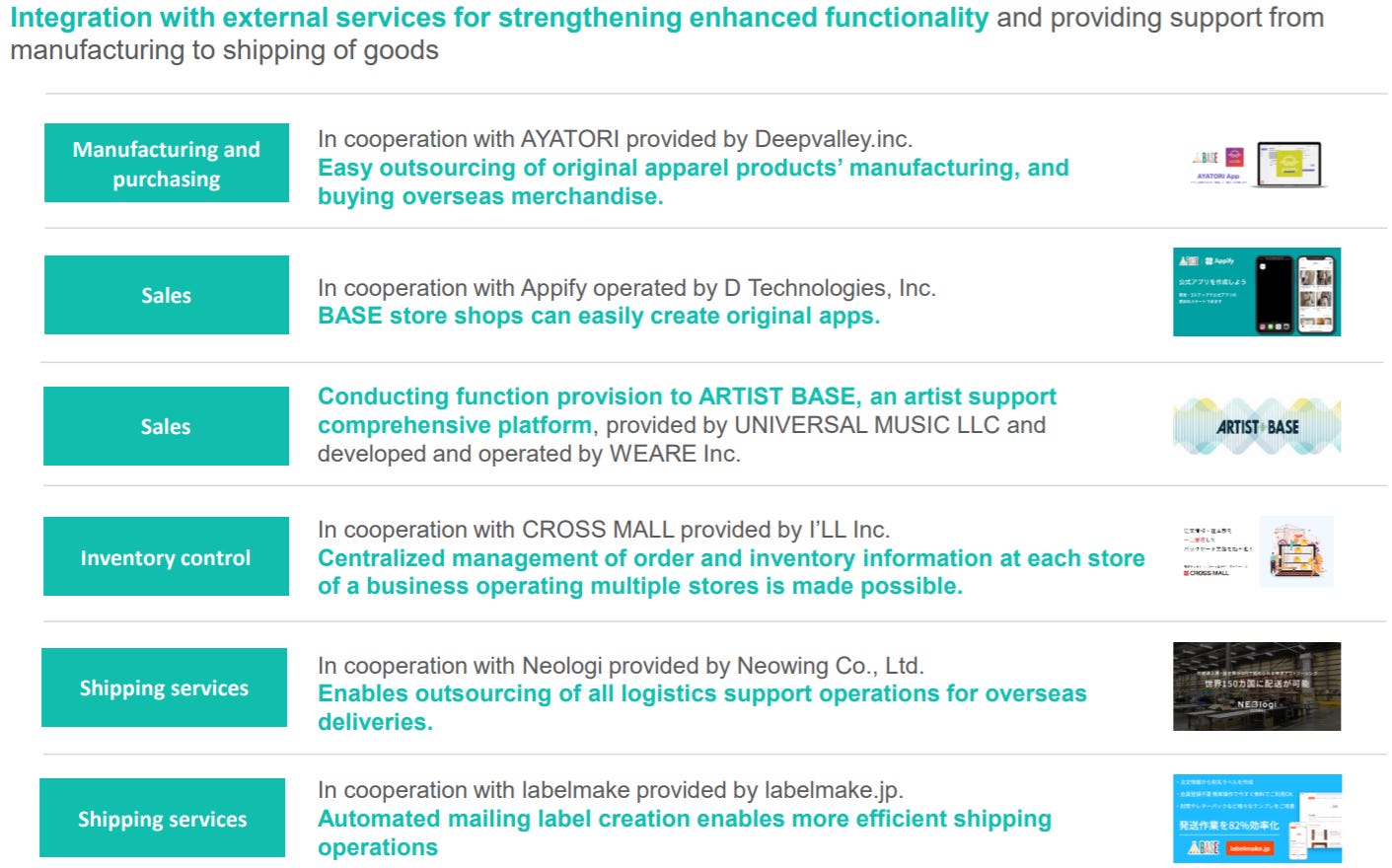

Further Build-Out Of Third-Party Integrations Driving Value & Increased Stickiness

BASE continues to find ways to increase the value & usability of its offerings by integrating with third-party tools & products that support their merchants’ businesses across currently non-core functions - again, further tying merchants into the BASE ecosystem & creating non-zero-sum, win-win-win outcomes for all parties involved.

JBI note: just as we’re seeing on Shopify, there is a growing opportunity to build very large, entirely new businesses on top of BASE by tapping into its massive merchant population via its merchant “app store”. A great example of this in the context of Shopify is Klaviyo. Klaviyo profitably grew to a $100M revenue business building an email marketing & SMS messaging software that largely grew off of Shopify’s expanding merchant base. These types of businesses represent compelling adjacent acquisitions and / or incremental products to be launched in-house (the latter being a risky, but viable strategy, as it gives pause to anyone seeking to build on top of Shopify, which is itself valuable to Shopify) for both Shopify & BASE.

Not Without Competition, Though Cementing A Leadership Position

Source: BASE internally managed survey

BASE is not without competition, with Shopify active in Japan as well as home-grown direct peers, such as STORES, who offers a very comparable product along with a similar free “basic” tier. On the stand-alone payment side, the competition is even stronger with Stripe, Softbank’s & Yahoo Japan’s PayPay, popular “buy now, pay later” late-stage startup Paidy & the ubiquitous LinePay, among others, all vying for digital payment flows.

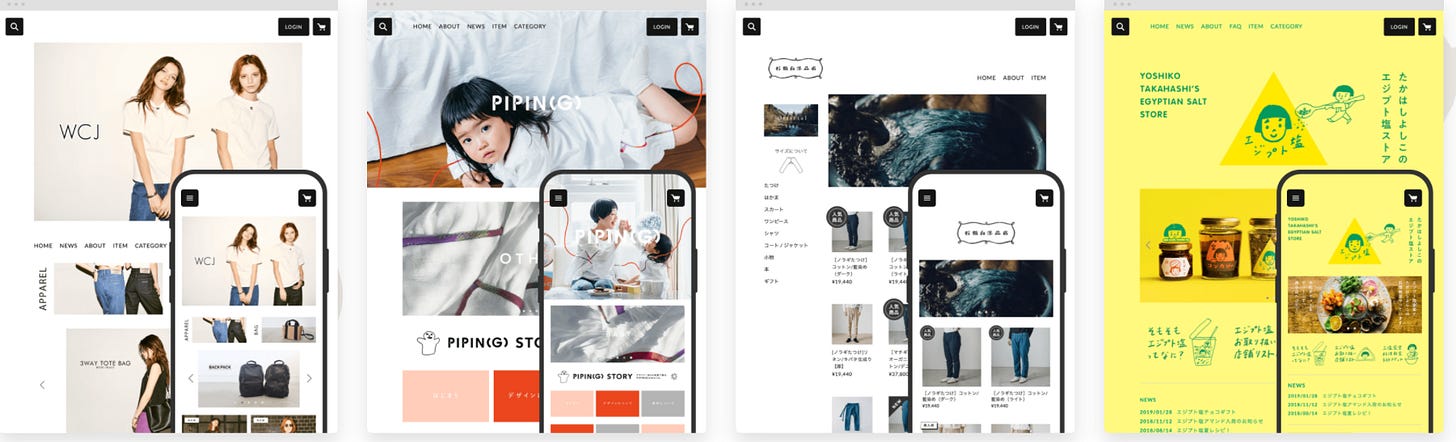

Example storefronts on BASE competitor STORES

Rapid Shift To A More International Shareholder Base

It is perhaps not surprising that overseas investors have rushed into BASE over the last 6 months, now representing 41% of shares outstanding today, up from 17% at YE2019. Of note, Mercari, the ~$7.5Bn Japanese C2C e-commerce platform active in Japan & the U.S., sold its holding in BASE in July of 2020, thereby dropping the Strategic Partners segment to 17%, not the 23% shown.

JBI note: our rational for including this slide is to point out the outsized role that international investors had in spotting the opportunity in & subsequently driving up the value of BASE during the COVID outbreak. One of our core theses at JBI is that, generally speaking, there exists a significant “arbitrage” opportunity from an investor’s perspective when looking at leading late-stage private & fast-growing innovative public technology companies in Japan. With execution, “moat-building” & broader growth strategies seemingly ever-more rapidly evolving in the more advanced global technology markets (i.e. U.S. & China), growth investors with i) a deep understanding of & true appreciation for all things Japan, coupled with the realization that what works elsewhere hardly ever is perfectly replicable in Japan; and ii) a firm “ear-to-the-ground” in, say, the U.S. tech ecosystem, these investors can bring a higher degree of conviction, a superior level of insight, an abundance of diverse, valuable international relationships & an overall more powerful value-add to management teams in the Japanese tech market. This “edge” is particularly valuable when leveraged within a broader investment structure / strategy specifically designed to capitalize on this opportunity (i.e. long-duration, private & public hybrid approach - think Altimeter Capital or Durable Capital - a type of firm that is yet to exist primarily focused on the Japanese market). Just to be clear, this above investor could very well be Japanese, American, Chinese or from wherever else - the “who” is not as important as the necessary “what” they can bring to the table.

To tie a bow on this post about BASE, we’ll end with a few closing thoughts:

BASE has built a very strong foundation from which to further grow its leading position in what is likely a winner-takes-most market in Japan. While not addressed in this post, we are not as convinced (yet) of the company’s ability to expand abroad for a variety of reasons. That being said, we don’t feel that such expansion is entirely necessary for BASE to grow five-fold from where it is today over the next 10 to 15 years.

As we think about the range of “known unknowns” - which is a fun thought exercise when operating in dynamic tech markets - there exists real potential for further explosive growth for BASE over the medium-term. As an example, our most “buy-now” inducing possibility is a partnership with Facebook. With its strong push to diversify its revenue beyond advertising & to better leverage its massive small business advertiser base, Facebook recently partnered with both Shopify & BigCommerce to accelerate its own e-commerce ambitions. Given BASE’s market leading position in Japan, its not far-fetched to assume Facebook may look to replicate this partnership model globally, perhaps looking to BASE for the Japanese market.

On the bear side, we’d highlight concerns around the quality & sustainability of the recent GMV growth, the still rather fluid, highly competitive domestic marketplace & a broader e-commerce market in Japan that will certainly continue to grow but will perhaps always trail its developed market peers in terms of speed of growth & depth of penetration

There is far more we could have written here, but this is already long enough. Thanks for checking it out & please subscribe!

The above is not investment advice. Do your own research. Opinions our own.

Thanks for the write up, helped me get more understanding on Base Inc

Dear JBI team, your articles are extremely insightful, more than any equity research reports in the public domain. I wanted to contact you directly and express my interest in perhaps scheduling a call to discuss your work and to share notes. However, I couldn’t find any contact information - I hope we would find a way to connect through this route. Would there be a good email address to contact you on? Kind regards, Michael