Demae-Can: The LINE "SuperApp" Backed Meituan, Doordash, & Just Eat Takeaway of Japan

Fully backed by "SuperApp" LINE, Demae-can is now set to "own" the domestic food delivery market & ultimately all local commerce logistics, aiming to scale revenue by ~10x within the next 3 years

In today’s post, we’ll be discussing one of the more exciting - though still sometimes controversial - emerging growth sectors: online food delivery. It is a fascinating space to study, though particularly so in Japan, given the cultural nuances around food & dining norms, city & neighborhood development, employment realities & much more.

Unlike our last post where we discussed tsukuruba - the Redfin & Opendoor of Japan - and categorized the company as an “early-stage venture investment available in the public markets”, the business of focus today, Demae-can, has been in existence for much longer (21 years), is far larger in size (~$2.3Bn market cap) and is much more dominant in its industry (#1 market share). So instead, we’ll call this one a “late-stage venture investment available in the public markets”.

We have loosely followed Demae-can for the past several years, though never felt terribly excited about the prospects of the business itself…until more recently. As we’ll further discuss, in March of this year, Japanese technology giant, LINE Corporation - whose eponymous “SuperApp” is equivalent in ways to WeChat in China - invested a substantial sum into Demae-can. Not only that, but LINE is also in the midst of merging its own food delivery properties into Demae-can, has installed one of its own executives as President & CEO of the company, has transferred tens of LINE employees to Demae-can & has just begun releasing initial product updates to its “SuperApp” that further integrates Demae-can into the broader LINE app ecosystem & better promotes the food delivery service among LINE’s 86M monthly active users in Japan.

Worthy of mention, while the company’s current focus is indeed on food delivery, Demae-can’s ambitions extend far beyond that. Its ultimate aim is “to establish Demae-can from a simple delivery service to a life infrastructure that is indispensable to Japan.”

Given such, and similar to tsukuruba, we believe Demae-can is today a highly attractive, long-term investment opportunity with significant “embedded option value” for a patient investor seeking to back a category-defining company competing with an “unfair” advantage in a large, under-appreciated domestic market still in the early innings of its “digital transformation” (what a mouth-full!). Moreover, as fervent believers in the broader “seller services” investment thesis (think: Shopify or Etsy, the latter of whom makes about 1/4 of its revenue from “seller services” such as advertising, packaging, a wholesale platform, etc.), we feel that Demae-can has barely begun to tap the full breadth & depth of its market & ultimate profit opportunity.

A Global Pioneer in the Online Food Delivery Space

Demae-can is the leading online food delivery company in Japan today. Originally called Yume no Machi Souzou Iinkai Co. until November 2019, the business was founded at the height of the dot.com bubble in September 1999. One month later, the now eponymous food delivery site, Demae-can, was launched. Notably, this was before every one of its major global food delivery peers ($ amount is current approx. market cap):

The company has been publicly listed since 2006 and has scaled via both organic and M&A driven growth, while also partnering with a good number of well-known businesses along the way. For example, though the service was discontinued in 2017, users were previously able to order on Demae-can directly via their Nintendo Wii. Additionally, the company is still today partnered with Amazon - which is interestingly quite popular in Japan - in offering AmazonPay beginning in 2015.

JBI Note: a brief history lesson for those interested. In Japanese, the word “demae” means “catering” or “meal delivery service”. In fact, the word’s origin dates back to the Edo period (from 1603 to 1868) & specifically refers to food cooked in food shops which was then delivered to the homes of primarily wealthy “daimyo”, or Japanese feudal lords. So common it was back then that you can sometimes see it depicted in “ukiyo-e”, traditional Japanese artwork from the 17th through 19th centuries. The below color woodblock print on the left is one such example, while the photo on the right is of an actual delivery-in-progress in 1935. Without a doubt, we’d drop every single dish, every single time!

Fast forward to 2020 and one will see Demae-can delivery persons cruising around on electric bikes & scooters in most major population centers.

Demae-can’s business model is best described today as a hybrid between the traditional marketplace model (i.e. GrubHub) & the logistics model (i.e. Doordash). Just Eat Takeaway is probably the closest comp from an end-to-end business model & strategy perspective. We’ll dive more into this later on. For now, let’s take a look at the broader food delivery market in Japan.

A Growing, Still Nascent Market Likely Requiring Some Additional “Push & Pull”

JBI Note: Before jumping into the weeds, we’ll note that further work is needed to obtain what we feel is a more accurate estimation of the current & future size of the online food delivery market in Japan. Of the few relatively credible, publicly available third-party sources we’ve come across so far, the growth analyses appear to us to be more linear in nature for what we’d argue will become more exponential over the next several years & beyond. As noted in our intro & as we’ll touch on again later, there are many unique cultural & other realities in Japan that may on the surface encourage one to assume a more conservative approach to projecting the medium-term size & growth of the online food delivery space. While we appreciate these factors, we also feel strongly that the increasing inertia of the digital transformation, or “DX” as they call it in Japan, building across virtually all industries - and that which is strongly supported by the Japanese Government & further boosted more recently by COVID - will reshape consumer & business behavior more than most anticipate today. This is before even taking into consideration the powerful “pull-through” of demand that a combined Demae-can & LINE will likely trigger.

According to a 2019 report by Yano Research Institute, the Japanese food delivery market, broadly defined, is set to hit ¥2.2Tn in 2020, or ~$21Bn, while growing around 2% to 3% annually through 2023. This number includes, however, an array of food delivery categories:

JBI Note: as we understand it, the largest category of “co-op” encompasses the purchase of food and / or other goods directly from producers / stores via mail, fax, telephone and / or online orders. Subsequent deliveries are also handled entirely by the producers, restaurants or stores themselves.

As a brief side-note, publicly listed Oisix ra daichi (3182) is worth a closer look if you’re interested in exploring the online grocery delivery market in Japan. The company primarily focuses on organic & other health-conscious foods. Its closest U.S. peer is likely Weee!, an impressive, already cash flowing online grocery delivery startup offering mainly Asian foods. The San Francisco based company saw >700% YoY growth during the summer of 2020 & has raised in total >$100M from top-tier investors, including DST Global, at a purported >$500M valuation.

For consistency’s sake, let’s cite Yano Research once more regarding Japan’s overall food service / restaurant market size. According to their estimates, total food service / restaurant spending in Japan is a ~$302B market as of 2018 (note: ~$600Bn in the U.S.).

So, using Yano’s numbers and assuming the broadest definition possible for “food delivery”, we get a food delivery penetration rate of about 7% (i.e. $21B / $302B).

Now, using another research firm’s market estimates, one who assumes a more granular definition of “food delivery” (i.e. online food delivery from restaurants), NDP pegs the market size at ~$4B in 2018, growing ~6% YoY (see below image). Using a presumed COVID driven, current market size figure of ~$7B for 2020 & applying that to Yano’s same overall food service / restaurant spending number, we get a market penetration rate for online food delivery of just ~2.3%.

Worth highlighting, NDP goes on to provide a market share breakdown of the food delivery space in Japan as of 2018. While they do not specifically detail which company is attributable to which market share percentage, we can confidently infer that i) the market remains rather fragmented with the top seven delivery services representing just 44% of the market; and ii) that Demae-can is almost certainly in the top two, if not #1. If you’re wondering, the 36% bar at the top of the graph represents orders & deliveries handled by restaurants themselves.

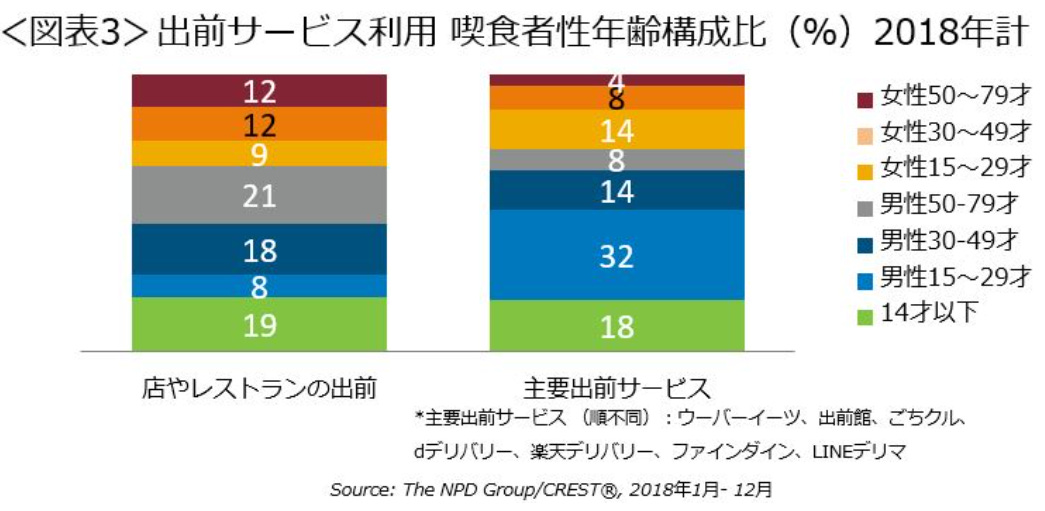

While we are discussing the NDP survey, we’ll also touch on their demographic breakdown of food delivery usage in Japan. We’ve noted below the top three age cohorts who use online food delivery services the most (i.e. Damae-can, UberEats, the right column). The left column shows the usage breakdown for “co-op”, or, again, direct order & delivery from shops / restaurants. Interestingly, we see that men aged 50 to 79 are heavy users of this “co-op” delivery model at 21%; this bodes well for ultimately converting a good number of these more “senior” consumers to the likes of Damae-can over time.

Men & Women aged 15–29 years - 32% & 14%, respectively

Men aged 14 & younger - 18%

Men aged 30–49 - 14%

Briefly, as a point of comparison, a February 2020 Morgan Stanley report estimates the addressable market for online food delivery in the U.S. to be $375B in 2020, with an estimated actual market size today of ~$34Bn, or a 9% penetration rate.

While perhaps not the most telling metric to compare, a bit of quick arithmetic nonetheless shows that, on a per capita basis, online food delivery spend in the U.S. is 87% greater than that in Japan.

JBI Note: Now, does this mean that Japan is simply lagging behind & there is ample room to further penetrate the market or, alternatively, is this signaling the existence of, say, cultural realities that may prevent similar adoption levels? Put another way, can per capita online food delivery spend in Japan ever match that in the U.S.? Or better yet, should it?

Tough to say, though attempting to answer that may also be missing the forest for the trees. The more simplistic & powerful thing to consider here is that the global food delivery industry as a whole remains in the early innings across just about every geography. Similar to SaaS adoption & its subsequent penetration rates, Japan does likely lag other developed countries in terms of online food delivery usage. Even if per capita spend never matches that of the U.S., we are hard-pressed to think of a scenario whereby the Japanese online food delivery market is not many times larger than today by the end of the decade. While we won’t delve too deeply into the tailwinds supporting our confidence here given that many of the more salient ones are generally similar across borders (e.x. shifting habits of digital-first Millennial & Gen Z consumers), we do want to briefly touch on the likely positive industry impacts of i) the oft-cited aging Japanese population; and ii) the less often discussed, though arguably just as impactful, changes in the female labor participation rate (i.e. an increase in dual-income households).

Dependency Ratio per World Bank data

As the increasingly digitally literate “Baby Boomers” continue to advance en masse into retirement, their growing fluency & comfort with technology & e-commerce more broadly will likely allow for an ever-lowering conversion hurdle for online food delivery services among this demographic. In fact, such services may become a necessity in some instances, as deteriorating health and other physical limitations may leave a growing number of seniors unable to shop for groceries, pick up their prescriptions or cook their own food. We’re getting ahead of ourselves here, but similar to DoorDash’s DashPass, it’s not farfetched to envision a similar monthly subscription offering for seniors (& really for anyone, to where Demae-can can “lock-in” its most frequent users), whereby the company provides daily meals to subscribers from a short-list of local restaurant partners, or perhaps even from Demae-can’s own future “ghost kitchens”, alongside other daily goods & weekly necessities (importantly increasing average order frequency & value). Notably, publicly listed Silver Life (9262) is explicitly focused today on delivering daily meals to seniors (& others), offering bento boxes & much more (though their overall business model is not “optimally designed” at the moment, all things considered).

Interestingly, we are in fact already seeing seniors actively join Uber Eats in Japan as delivery people. It is not a big leap to imagine these same individuals flipping to the consumer side, be it on UberEats or Demae-can.

Moreover, with the female labor participation rate rapidly rising in Japan in recent years, with likely further gains to come due to increasing labor shortages, additional Government encouragement & continued stagnation of real wage growth for households, food delivery could very well become an increasingly affordable, time-saving & convenient option for the growing number of dual-income households across Japan.

Red Dotted Line - “Housewife Households”; Black Line - Dual-Income Households

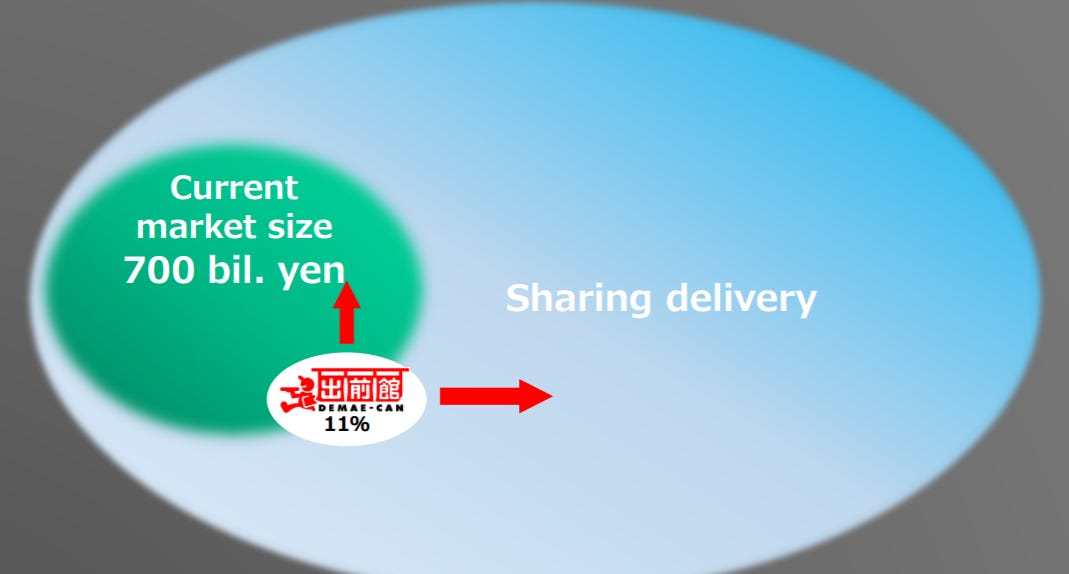

While it is often advisable to take industry & company projections from management teams with a grain of salt, it is nonetheless important to highlight Demae-can’s far more bullish view on the near & medium-term prospects of the online food delivery market in Japan. More specifically, the company anticipates a 20% to 30% industry CAGR through 2023 from an existing online food delivery market size of ¥700B, or ~$6.7B. Much of this expansion, however, is anticipated to be driven by Damae-can itself, who is projecting market-beating growth in its own GMV over that time period, with its 2023 GMV equaling 60% to 70% of the estimated industry-wide GMV for 2020E.

Let’s continue our discussion of the broader market as we take a closer look at Demae-can the business.

A Steadily Growing Presence With A Recent COVID & LINE Driven Inflection

According to a 2018 Economic Census for Business report by the Ministry of Internal Affairs & Communications, there are an estimated 499,542 restaurants in Japan. Let’s assume that industry figure returns to this level post-COVID & let’s also assume that ~30% of that total includes bars & nightclubs, leaving us with ~350k restaurants within Demae-can’s addressable market.

As of November 2020, the company had roughly 40,000 partner restaurants on its platform (JBI Note: point of comparison, Doordash had ~390k as of Sept 2020). Easy math will give us a ~11.5% restaurant penetration rate. As the below chart shows, COVID unsurprisingly played a significant role in rapidly growing the number of affiliated restaurants of late.

Demae-can’s internal estimates place its market share at just 11% of the current existing addressable market. This resonates with the above shared NDP survey results, where the industry leader had a mere 10% share in 2018.

The following charts detail the company’s active user numbers, number of orders & average number of orders per user per annum since 2010.

JBI Note: very interestingly, and perhaps due to it being around for longer, Demae-can’s average # of orders per user per year is markedly higher than that of Doordash’s, where the average customer places ~1.6 repeat orders in year one, ~3.5 orders in year two, with an average of 20+ orders in their first five years. In Doordash’s case, the 5-year ROI on their CAC is ~900%, implying that Demae-can’s is almost certainly several orders of magnitude higher, particularly once fully integrated into LINE’s “SuperApp” ecosystem (which we’ll get to shortly). On the other hand, there may be little room for further expansion in this existing user metric over the near-term. As a result, a (more expensive) push to “land grab” new users would seem paramount for incremental growth, though also extremely valuable given the possibility of rapidly driving these new customers to the current annual order number average.

According to management, leading overseas food delivery companies are today far larger & more penetrated on an active user to total population basis.

Demae-can believes that it can at least 3x its current user base, and may even be able to raise it by as much as 10x, over the next several years.

Inside The Demae-can Experience

So, what exactly does the Demae-can app even look & feel like, right? Well, let’s start with what consumers are seeing of Demae-can on their way to work and, more recently, on TV:

(JBI Note: the gentleman in this video is very well-known comedian Masatoshi Hamada)

In a recent consumer survey, Demae-can was selected #1 among food delivery services across three categories: Reliability, Quality of Delivery Staff & Better Deals:

Diving into the ordering experience itself, a critical competitive consideration for any online food delivery company is the depth & breadth of restaurant selection, both in terms of food type & localized geography. Using Doordash as a perfect example, the company early on pursued what was at the time a counter-intuitive approach of focusing on the less densely populated & more chain restaurant driven suburbs, instead of the more densely packed, independent restaurant driven urban areas, where the likes of GrubHub, UberEats & Postmates were already or well on their way to dominating. As a relatively underserved market with few, if any, on-demand food delivery options, the suburbs provided Doordash with a profitable “white space” in which to rapidly scale & hone their execution capabilities without much competition.

Relating this to Demae-can, “on-the-ground” research & anecdotal evidence both suggest that the company has taken a quasi-similar approach to Doordash by expanding its restaurant footprint beyond just the core urban centers & seeking to offer as diverse of a food selection as possible.

Regarding the former, Demae-can asserts that they currently can serve ~30% of the Japanese population. Their aim is to broaden this coverage to 50% by August 2023. As we’ll note shortly with a brief “real-life” example, Uber Eats - Demae-can’s primary competitor - still remains today a predominately “city-centered” service, just as they arguably are in the U.S.

Notably, among its domestic peers, Demae-can also has what is likely the highest percentage of QSR / chain restaurants on its marketplace. To that end, they have been aggressively adding McDonald’s locations recently, with the total available stores now numbering 850. Other well-known international & domestic partner chain restaurants include:

JBI Note: as with most consumer oriented technologies & companies, it helps to hear it, see it & experience it for yourself. Since few readers, we imagine, are able to be in Japan at the moment, we’d encourage you to check out the below relatively brief YouTube video, where the duo compares the selection & ordering experience on both Demae-can & Uber Eats. Of course, this is a single review, so take their findings & opinions as just that.

We’ll highlight a few of their observations from the clip for those less inclined to watch:

Demae-can - where they ultimately ended up placing their order

Immediately upon opening the app, a coupon for McDonald’s is surfaced

The delivery fee drops from ¥420 to ¥350 with a min. ¥800 order

Overall food selection is quite varied, with numerous options across washoku (traditional Japanese food), yoshoku (Western influenced Japanese food) & your standard Western meals, such as pizza, burgers, etc.

Restaurants & food options were plentiful when searching from both a more suburban address as well as right downtown in Tokyo, in the heart of Shibuya

Uber Eats

Offers primarily Western food - pizza, burgers, etc.

Restaurant options are quite limited away from urban metro stations

Delivery fee is ¥250 with no minimum delivery, likely due to most restaurants being located near metro stations (i.e. order density)

UI / UX is more clunky & in some instances didn’t even load

While still accounting for a very small percentage of overall affiliated stores, non-restaurants - such as grocery stores, dry cleaners & locksmiths - are beginning to join the Demae-can platform. This will likely be further encouraged by Demae-can over time, just as its U.S. peer Doordash explicitly states in its recent S-1:

While we started by enabling food delivery, our plan is to build products that transform the way local merchants do business and enrich the communities in which they operate. Over time, we will build three mutually-reinforcing assets to enable this vision:

An on-demand logistics platform that can facilitate the local delivery of any item

Merchant services to grow sales in the modern era

A membership program to the physical world for consumers

JBI Note: Briefly, on the topic of online grocery delivery, some may argue that grocery has no where near enough margin to allow for sustainably profitable delivery. We feel that over time this will change, as so-called “dark stores” will become the primary fulfillment centers for online grocery orders (vs. today’s high rent, larger footprint retail locations). Such “dark stores” can drive higher inventory turns + will have materially lower rents, which should provide the margin necessary to power a profitable grocery delivery world.

As a quick side-note, another interesting & rather innovative Japanese tech company will run head-on into Demae-can in this broader “on-demand” delivery arena. Raksul’s Hacobell unit is scaling well in building out a similar “on-demand" delivery logistics platform. Well worth another post at some point:

A Closer Look At Demae-can’s Strategy & Structure

Zooming out some, Demae-can offers three distinct products:

Demae-can Marketplace - connects consumers & affiliated merchants

Sharing Delivery - provides outsourced delivery logistics for said merchants

Mail Order - in partnership with select shochu producers, provides izakaya bars with white-labeled, limited edition bottles

We will ignore the Mail Order business, as it is quite small & in decline today.

As noted earlier, with regards to its core food delivery offerings, the company closely mirrors that of Just Eat Takeaway. In other words, like Just Eat Takeaway, Demae-can has begun to marry its historically profitable incumbent marketplace business - which enjoyed a mid-teens to mid-twenties percent EBITDA margin - with a more capital-intensive, currently loss-making logistics model (i.e. similar to that of Doordash). At the same time & briefly touched on in the last section, one could argue that Damae-can is also increasingly adhering to an aspect of Doordash’s playbook outside of core cities like Tokyo & Osaka: build out a logistics delivery business that increasingly focuses on under-served second-tier markets, while leveraging quick-service-restaurants’ marketing budgets to drive incremental awareness & adoption.

With regards to the company’s original marketplace offering, it is a relatively straight-forward business that most likely understand today. In short, consumers visit Demae-can’s website or app, browse & select a restaurant, place an order & the restaurant will then handle the prep & delivery on its own. In using Demae-can, restauranteurs are able to broaden their reach and, in theory, drive net-new orders they otherwise would not have had. As a result of facilitating that transaction, Demae-can receives a one-time ¥20,000 (~$192) initial set-up fee once the restaurant joins the marketplace & an ongoing per-order commission of 10% of the total order cost, before tax. Restaurants, however, can increase menu prices on Demae-can to account for the added cost - just as is the case on Grubhub & Doordash, for example.

Where the company’s strategy & ongoing internal investments become really interesting, however, is in examining its Sharing Delivery business, which only recently launched back in 2017. Quite simply, the offering is intended for restaurants without their own delivery resources / capabilities.

JBI Note: unlike Grubhub, who arguably fell victim to the classic “innovator’s dilemma” - whereby they delayed the painful “cultural re-write” of transforming from a profitably growing marketplace business to a capital-intensive, medium-term loss-making hybrid with logistics. Put another way, Grubhub too-long dismissed / reacted too slowly to upstarts leveraging what they deemed to be an “unviable” logistics strategy, preferring instead to conserve existing profits under their existing marketplace model. As a result of their delayed & frankly weak ultimate response in since building out a logistics business, Grubhub has subsequently lost significant share to the likes of Doordash…so again, unlike Grubhub, Demae-can not only quickly appreciated the disruptive threat that a logistics-first Uber Eats brought to the Japanese market in 2016, but they also rapidly responded with the launch of Sharing Delivery the following year. As you’ll soon see, with LINE now fully behind them today, Demae-can is in fact doubling down on its logistics strategy in a big way.

Now, when thinking of “logistics” in regards to food delivery, most presumably cite the common use of “gig workers” to actually facilitate the deliveries. Interestingly, Damae-can goes a step further. Not only do they directly employ delivery people - just as Just Eat Takeaway does in its highly profitable, initial Dutch market - they also establish small delivery bases from which these delivery personnel are dispatched.

Historically, Demae-can has set up these delivery bases in partnership with other relevant companies, such as within Asahi Shimbun's existing newspaper delivery offices, ASA. The overlapping necessity to delivery their respective goods to consumers’ doorsteps made such partnerships mutually beneficial.

That said, more recently & particularly with LINE now deeply involved, Demae-can is aggressively moving towards company managed delivery bases to better control all aspects of their operation & execution. This makes a lot of sense given the importance of both speed (i.e. <30 mins) & quality of delivery service, particularly so in a country like Japan where customer service is absolutely paramount.

JBI Note: in Japan, customers are meant to be treated like royalty. No, really…there is a common phrase in Japanese used within the service sector - “okyakusama wa kamisama desu”, which can be directly translated as “the guests / customers are god”. More lightly put, “the customer is always right”.

Notably, Demae-can’s investment here extends beyond the mere addition of physical delivery bases to help drive route density & minimize delivery times, but also in training its in-house delivery people. The company has gone so far as to establish a dedicated internal training center for their delivery employees. As is typical in Japan, these “corporate students” are required to deeply familiarize themselves with detailed manuals, standardized protocols & specific codes of conduct, which they are expected to closely adhere to once in the field.

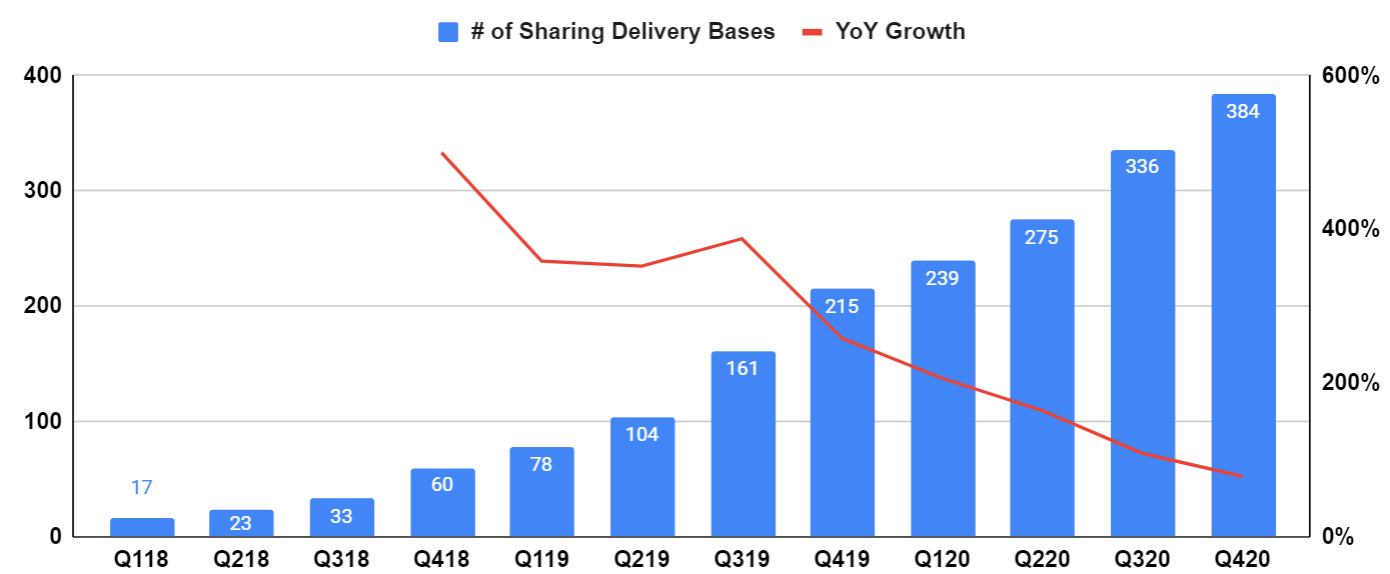

Now, if we fast forward to fiscal year-end August 2020, we see that Demae-can grew the number of delivery bases by 79% to 384, a majority of which are company managed. By October 2020, the total number of in-house delivery personnel hit ~6k, with another ~4k employed by those external groups overseeing their partner delivery bases. Worth highlighting, Sharing Delivery related GMV grew 4x YoY during the April to June 2020 time period.

For their directly managed delivery bases, Demae-can leases what is often a very small building or retail store front in addition to a few motorbikes, a handful of electric bicycles and / or, in some rare cases, a car. All-in, establishing a base requires an investment of ¥20M to ¥30M, or $190k to $290k, over the first 12 to 16 months of operation. In order to hit individual base-level profitability, the company believes it needs to hit >2 deliveries per hour, depending on location specific personnel & lease costs. However, with company-wide average deliveries per hour clocking in at just 1.5 today, only 20% to 30% of their managed bases are profitable at the moment. Realizing that many of these bases are still quite new, efforts to drive increased local restaurant & user density as well as subsequent order frequency will go a long way in pushing a greater percentage of these delivery bases into the black.

JBI Note: so, a couple of things…i) there is a good bit to digest here; ii) ideally, we wish had some additional base-level data disclosure (i.e. avg. # of employees per base, is it >2 deliveries per base per hour or per delivery person, etc.); and iii) there is a bunch of additional analysis that should be done to better understand the economics in running these individual bases. As this post is only half way home & already approaching novella length, we’ll refrain from heading in this direction for now.

More generally, though, we do think the long-term implications of having a “hub-and-spoke” (vs. “point-to-point”) delivery apparatus that is predominately operated in-house allows for an overall more superior, consistent, flexible & ultimately profitable “user experience” for each of consumers, merchants & delivery personnel alike. We’d also argue that food delivery businesses are, at the end of the day, service businesses, where consumer habits, expectations & brand affinity will tend to harden & become entrenched over time (as subsidies can’t last forever), with those companies primarily leading with selection & quality of experience earning the critical mindshare & trust across ecosystem partners to best “own” the market. As a result, making these brand & quality focused “investments” early on, when the market is so large yet still quite nascent, is very wise on the part of Demae-can. Remember, the value proposition for online food delivery is simple (though not easy): selection, user experience / quality, affordability / price, speed…& specifically in that order, in our view.

Also, let’s not forget that the potential for these delivery bases to take on additional, value-accretive responsibilities in the future (i.e. “ghost kitchens”, a centralized location for take-out order pick-ups, etc.).

For those of you well versed in calculating the potential economic damage to Uber Eats & Doordash should Prop 22 have not recently passed, it may be interesting to learn that Demae-can pays it’s part-time & full-time delivery personnel between ¥1100 to ¥1200 per hour ( ~$11) & sets available work hours between 11AM to 3PM & 4:30PM to 9PM. Two hours of paid overtime are available per shift and one can work just a single day a week if they can commit to three months or longer. It appears they heavily recruit students & are increasingly attempting to cater to housewives & seniors.

That said, Demae-can has just begun exploring the “gig worker” angle, with recent job postings for “on-demand” delivery personnel, where the company requires existing access to personal transportation & a smartphone. These “gig workers” are apparently to be compensated on a flat-fee-per-delivery basis with volume incentives.

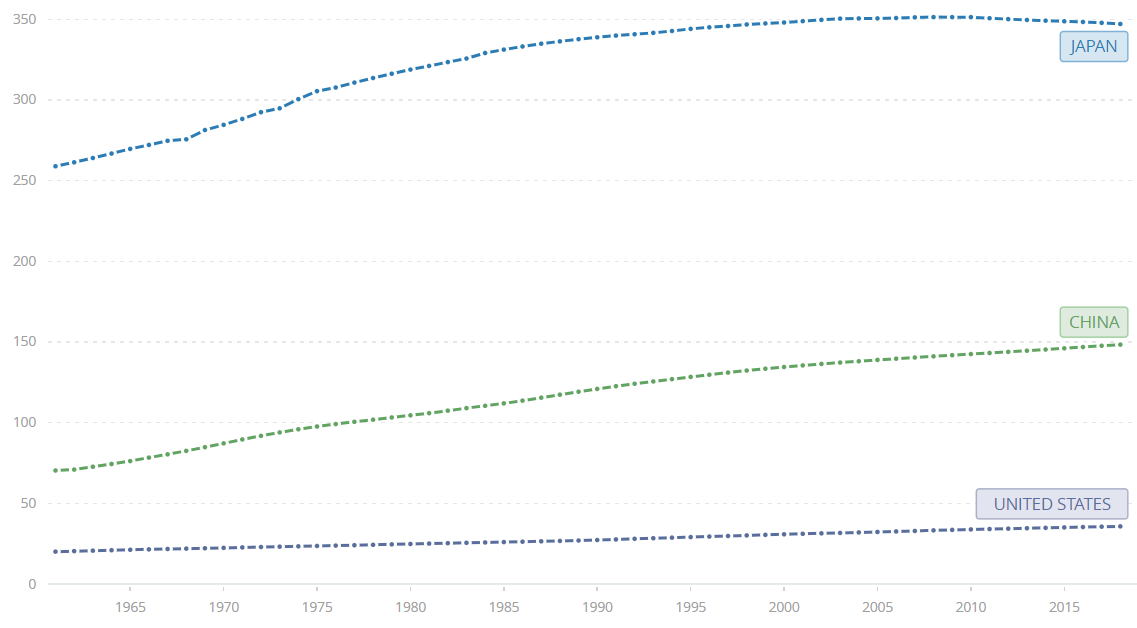

Last comment here…we think a comparison to Meituan of China makes a lot of sense when thinking about Demae-can’s ability to profitably scale its broader food delivery, and Sharing Delivery logistics business more specifically. Core to Meituan’s recent success in turning its food delivery business profitable is the high population density & growing urbanization of China, coupled with the relatively low labor costs of its couriers, who almost exclusively deliver via bikes & scooters (i.e. easier & faster pick-up + drop-off, unlike cars in the U.S.). The below chart from the World Bank shows the population density of people per sq. km of land area in Japan, China & the U.S. Japan leads by a huge margin & likely even more so when only considering the more urban & suburban areas of each country.

Moreover, Meituan’s “super-app” - and thus by extension its overall strategy & ultimate success to date - is a very telling “case study” of sorts for Demae-can once it is fully integrated into the LINE “SuperApp” ecosystem (again, more to come on this). The below graphics show what is Meituan’s “SuperApp” vs. that of LINE’s varied in-app offerings, in addition to data depicting Meituan’s superior user retention & stickiness given its SuperApp approach vs. that of its domestic competitor, Ele.me.

Lastly, similar to China, SMBs in Japan - who are underserved & under-allocated to traditional online advertising mediums like Rakuten, Google or Facebook - are more likely to spend marketing budgets on LINE after seeing increased order volume & revenue from Demae-can / LINE users. This should, in theory, open up an up-till-now non-existent, high-margin advertising revenue stream for Demae-can in the future. As a result, one could argue that food delivery for Demae-can could become like e-commerce is to Amazon in this instance (i.e. low-margin e-commerce growth drives increased high-margin merchant advertising spend). Notably, Meituan’s food delivery advertising revenue reached $275M during the quarter ended June 30, 2020, growing 95% YoY.

In just three years since its launch, the Sharing Delivery business already accounts for 20% of Demae-can’s total GMV. By August 2023, Demae-can managements expects this to rise to ~50%, with delivery bases in every prefecture in Japan by then.

With regards to pricing, remember that Demae-can charges a service fee of 10% of the total cost of each order. Should the particular restaurant use Demae-can’s Sharing Delivery offering, there is an additional fee of 30% of the total order cost (note: a ~3% payment processing fee exists, but is passed through at-cost, so is gross profit neutral). On the surface, this all-in cost of 40% may seem high, though i) the company has publicly expressed their intent to lower this fee over time; and ii) the fees charged by Demae-can’s U.S. peers are not drastically different:

To provide some additional context here, management estimates Sharing Delivery’s addressable market to be ~374k restaurants, representing $124B in prepared food spend. This is a massive market opportunity, which today is likely just 2% to 4% penetrated in terms of the number of viable restaurants using Sharing Delivery.

The “Kingmaker”…The LINE “Partnership”

Briefly, for those less familiar with LINE, the best comparison would be with that of WeChat, the leading Chinese “SuperApp”. LINE’s eponymous messaging app today offers products that touch just about every aspect of daily life for its ~86M domestic monthly Japanese users, be it LINE Pay for payments, LINE Pocket Money for personal loans, LINE NEWS for the latest worldly updates, LINE Travel for travel bookings or LINE Shopping for all your e-commerce needs, among much more.

Even more profound, LINE is in the midst of merging with Softbank-backed & fellow domestic technology powerhouse Yahoo Japan. Mind you, Yahoo Japan has ~67M MAUs & 3M “business clients”.

JBI Note: for those of you thinking Softbank has a soft spot for Uber & wouldn’t dare support Demae-can’s market domination dreams, think otherwise…Softbank owns ~25% of Doordash…Uber Eats be damned!)

The combination of these two dominate groups in Japan will create a technology behemoth the scale of which has never been seen before in the country. Their subsequent control of & growing insights across the Japanese internet economy will be immense.

Suffice it to say, any organization partnering with LINE today will have an unparalleled degree of financial firepower, access to top talent, connections to virtually all corporate & government decision-makers & extreme consumer reach / influence. In thinking about this above reality & in relation to LINE now aggressively backing Demae-can, we are reminded of a very recent interview by an astute, up-and-coming investor Dan McMurtrie, Founder of Tyro Partners . We loosely quote him below:

“More and more businesses are playing “to win”…and you need to look at their capital base, their investors. For example, a bunch of funds, who are really smart & have a lot of capital, have decided that this particular company is the one we are going to support relentlessly with however much money they are going to need…because, way past the current valuation today, this is the company that has the capacity “to win” & has the momentum & the KPIs we think that will lead to winning…so, we will continue to fund it.

The key here is orthogonal market information & interpretation frameworks…or put another way, completely unrelated information & interpretation frameworks. As an example, you and I might look at a company & think the cash flows or the return on invested capital is not high enough to justify the current share price…but the real issue here is that the people who are funding this company are thinking about it as a venture capital bet that happens to be publicly listed, and their reason for investing is that in 10 years this business will have 60%, 70%, or 80% market share in what is a massive market. So, the only thing that matters is 1) will these people quit on that vision; or 2) will someone have their capital pulled to where they can’t back it anymore.

A great example of this is Grubhub vs. Doordash, whereby Doordash did a massive round with the explicit mandate to not care about unit economics, just to murder Grubhub. One thought is that these people are fools & gambling money, though the other is that these people investing in Doordash, who just bet $1.5B to $2B, are doing so to utterly “win” the market…now that is a BIG bet. As a result, they will do everything to make that happen - and not just financially. These investors are helping the company in every way they can - introducing them to business partners, top talent, etc. This comes back to evaluating a company as a network & looking closely at the “full army” that the company has…I want a reasonably valued, very unfair fight. I don’t think people really understand how advanced this game has become.”

JBI Note: We think this take is absolutely spot-on when discussing the winner-takes-most markets increasingly common in today’s tech-driven, competitive business environment. As we transition back to Demae-can, some of the questions to ask then are:

Will LINE ever bail on Demae-can at some point? (unlikely)

Is LINE bringing its “full army” to bear? (yes)

Does Uber have the financial wherewithal & commitment to the Japanese market to attempt to go toe-to-toe with Demae-can & thus LINE over the long-run? (TBD)

As you’ll quickly grasp when reading through the below details of LINE’s deepened partnership with Demae-can, it becomes clear that Demae-can is now bringing a bazooka to its current knife fight with Uber Eats.

More specifically, Demae-can’s renewed partnership announcement with LINE was publicly disclosed on March 26, 2020. Upon understanding the extent of this tie-up, it would appear that Demae-can is now all but a publicly listed subsidiary of LINE & its affiliated entities:

Demae-can issued 41M new primary shares to LINE & Mirai Fund (an investment entity 90% controlled by LINE’s largest shareholder, South Korea based NAVER Corp.), equating to an aggregate amount of ¥30B (~$285M) at a per share price of ¥730 (note: Demae-can’s share price is hovering near the ¥3,000 mark of late)

LINE & Mirai collectively received two Board seats & today hold ~36% & ~25% of Demae-can’s outstanding common shares, respectively

Demae-can’s now former President & Chairwoman, Rie Nakamura, has assumed the role of Executive Adviser, while 44 year old LINE executive & existing Demae-can Board member, Hideo Fujii, is the company’s new President & CEO. Fujii san is a tenured technology operator with prior experience at Rakuten & most recently as CEO of LINE’s O2O business unit(s)

Demae-can relocated its head office to inside that of LINE’s Tokyo-based headquarters

LINE directly transferred to Demae-can dozens of its in-house engineers, developers & marketing personnel

LINE’s own food delivery service (LINE Delima) & its takeout ordering product (LINE Pokeo) are to be transferred to & re-branded as Demae-can

Demae-can’s user ID system will directly link with that of LINE’s, to create a new ID system known as “ONE ID”

Together, LINE & Demae-can plan to attack the following initiatives, among others:

Build a comprehensive food marketing platform, including food delivery, take-out, dine-in, mobile ordering & “cloud kitchen” capabilities. An example of such a future product would be the introduction of a (defensive) offering similar to that of Doordash’s merchant focused, white-labeled, D2C Storefront SaaS tool with its flat $2 delivery & no-cost pick-up fees (think: a “BASE / Shopify offering” to complement Demae-can’s core “Amazon platform” today). The “merchant services” thesis begins to shine through here.

Upgrade software management tools for store operators & develop a customizable consumer UI

Improve business intelligence & overall KPI tracking capabilities

Over the medium-term, expand to other Asian markets, particularly where LINE remains dominant today, including Taiwan, Thailand and, to a lesser degree of late, Indonesia

JBI Note: while we would normally err on the side of fully discounting any potential upside from international expansion in such a case, it is worth noting LINE’s traction & commitment in capitalizing upon its dominant existing position in Thailand today. To that end, in July 2020, LINE announced that it had raised $110M from Asia focused tech growth investor BRV Capital Management (affiliated with Menlo Park based BlueRun Ventures) for its Thailand focused LINE MAN unit. Funds will be used to accelerate growth & allowed for the merger with local restaurant review & discovery platform, Wongnai (~10M MAUs). Briefly, LINE MAN offers its >3M users on-demand services within food delivery, groceries, convenience store items and parcels as well as messenger and taxi hailing services…so, think of it as a Thailand focused competitor of Southeast Asian SuperApp Grab.

Of the ~$285M raised, Demae-can management expects its $155M in marketing related expenses (i.e. investments) to breakdown as follows, with the majority flowing into brand awareness & net-new user acquisition efforts:

JBI Note: With an online food delivery penetration rate of, at most, 4% of total restaurant food spend in Japan today, the market is still in the first half of the first inning. It is frankly not only prudent, but necessary to aggressively sign up new users & merchants as rapidly as possible at this point.

While somewhat dated, we feel a 2015 global food delivery study done by McKinsey supports a key reality of the market that has more recently been somewhat “obscured”. Namely, that, in the absence of today’s seemingly endless, long-term unsustainable, gross profit negative subsidies / promotions, users of food delivery platforms tend to be rather sticky (e.x. the 5M Dashpass users today are a testament to this). The present day food delivery platform who best invests in nurturing the quality & growing trust within their user, merchant & delivery personnel ecosystem will likely have the highest probability of achieving & an easier time subsequently retaining a durable market leadership position over time.

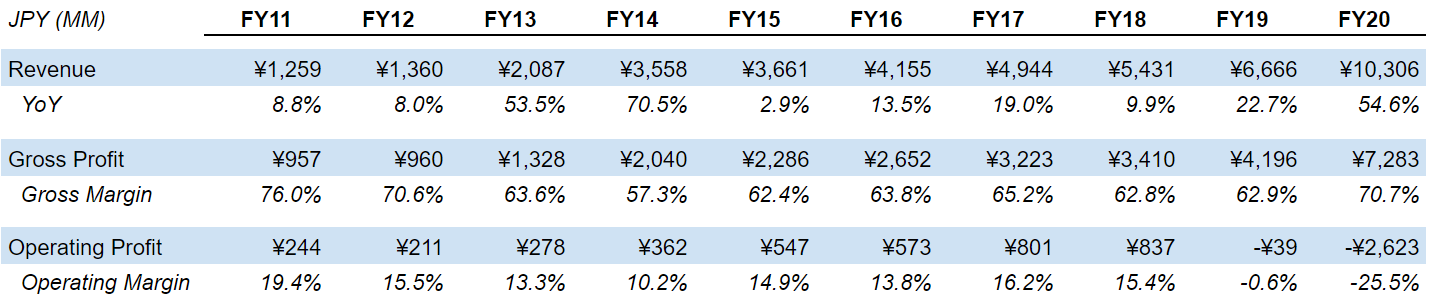

A Profitable Past Funding A Transformative, Step-Function Up In Size & Scope

So, how does this partnership with LINE exactly impact Demae-can’s fortunes moving forward? To answer this, let’s start with a look at the company’s historical financial performance:

Operating as a non-logistics based marketplace for much of its life, Demae-can has historically enjoyed consistent mid-teens operating margins & very respectable gross margins since FY11. Beginning in FY19, we begin to see the increased investment into their logistics-based efforts with Sharing Delivery. We can also see via the below graphic that the company’s Sharing Delivery business is growing at an exponential rate, up 613% YoY as of August 2020.

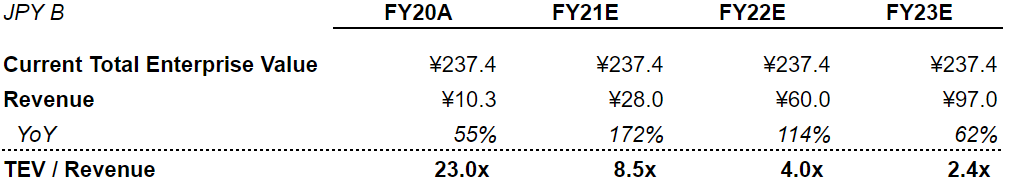

With that baseline, we can now better appreciate the exceptional growth in GMV & revenue that Demae-can management anticipates through FY23:

While GMV is set to >3x, revenue is projected to ~10x! The rationale behind the rapidly increasing “revenue as a % of GMV” metric is due to management’s expectation that the percentage of affiliated restaurants using its Sharing Delivery service - where they charge a 30% delivery fee - will grow from ~20% in FY20 to >50% in FY23.

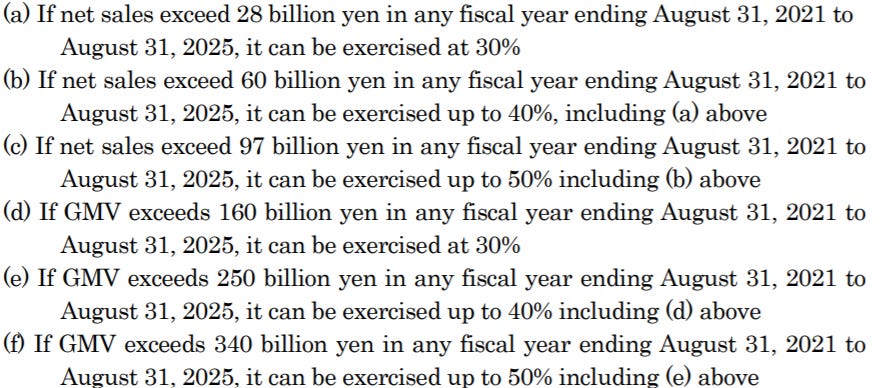

JBI Note: it is helpful to see that management’s ability to exercise their stock options are aligned with these corporate goals, even if given an extra two years of leeway:

Unsurprisingly, the number of affiliated restaurants is projected to ~3x within that same time period to >100k.

To accommodate this explosive growth, the number of delivery personnel is expected to rise from ~6k in October 2020 to tens of thousands, with aggregate part-time courier wages growing 3x to 4x from today. We can also clearly see this anticipated growth illustrated in the below graphic, where “Delivery Commission” explodes relative to the other revenue categories.

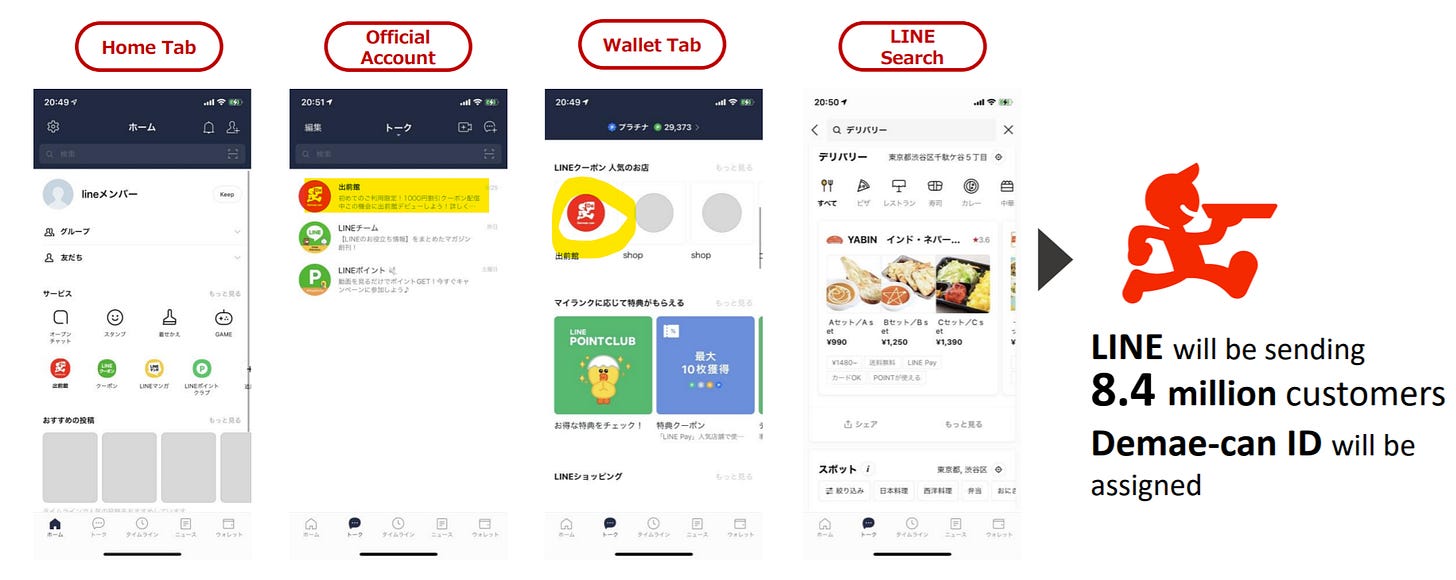

Underlying much of this growth is the effective doubling of Demae-can’s geographic coverage area to >50% of the Japanese population, coupled with the upside that comes from Demae-can being actively promoted in a SuperApp in which 73M individuals (i.e. 86M MAUs, of which 85% are DAUs) - or 58% of the entire population of Japan - actively message, explore, read & do much more on a daily basis.

JBI Note: while we’ve outlined earlier how dominate LINE truly is in Japan, it is worth stating it once more…LINE is absolutely dominate in Japan! Why this matters so much & why Demae-can’s partnership with LINE is such a game-changer not only for the company, but also for the domestic food delivery space (& frankly the future on-demand logistics industry more broadly) is that it totally restructures the industry’s competitive power dynamics & tilts the game very heavily in favor of Demae-can. The simple reason being, as we just highlighted above, LINE’s ability to instantly put Demae-can at the finger tips of 73M people on a daily basis in a app they habitually access countless times a day. This certainly matters on the consumer side, but don’t forget merchants & restaurateurs as well - they too are on LINE, be it as individuals and / or as a business.

The below graphic depicts management’s view of their new customer acquisition & existing customer engagement activities once Demae-can user IDs are merged with their respective LINE IDs - which was just completed at the end of November.

With Demae-can’s ability to now leverage existing & continually growing LINE user data to better target & re-target consumers with personalized food coupons, “cross-selling” opportunities, & so on, directly in app, you begin to wonder how the likes of a stand-alone Uber Eats food delivery app can continue to compete. Let’s not forget, Uber Eats was, by far, the best funded & most focused food delivery company in Japan up until March 2020. Fast forward to today, they are now effectively facing off against what is a fully committed, preeminent, home-grown consumer technology powerhouse in LINE (& Yahoo Japan).

In order to adequately compete over the long-run, we’d argue that Uber Eats’ ecosystem participants’ “user experiences” need to be materially superior to that of Demae-can’s. We’ll never say never, but the odds are now powerfully stacked against them. So much so, in fact, that rumors were flying as recent as August 2020 that Demae-can was in talks to acquire Uber Eats Japan. Such rumors were denied by Demae-can, however, given Uber’s increasing focus of offloading “non-core”, money losing businesses (which we approve!), we could see this conversation resurfacing, with Uber either outright selling (in a Japanese market, mind you, where their traditional ride-hailing business is basically a literal taxi hailing app due to regulations) or merging with Demae-can in order to retain upside in the sizable, under-developed Japanese food delivery market (e.x. Uber’s stake in China’s Didi…which it will likely also sell).

As we’ve referenced earlier, we need not look any further than to that of Tencent’s WeChat to see the “kingmaker” playbook in action. As an example, Tencent has put the weight & power of its ubiquitous WeChat app behind the likes of Pinduoduo (to the tune of an ~18% economic stake), helping turn $PDD into a ~$175B market cap company in just 5 years.

A Crowded Market…With Mostly Under-Resourced & Over-Matched Peers

As we’ve discussed them numerous times thus far, we’ll start with Uber Eats.

It is important to first recognize one of the significant benefits of Uber Eats’ having entered Japan in late 2016. Their investments into building general awareness about the convenience, attractiveness & benefits of online food delivery was extremely powerful in helping to seed & accelerate industry-wide growth. While Uber Eats is indeed still growing rapidly, it is almost certainly off of a still rather small base:

Sourced from the limited publicly available information regarding Uber Eats’ Japanese business, we know a few other things:

Fees typically fall at about at 35% of the total order cost as of October 2020

Available in 34 cities in Japan, including Tokyo, Kanagawa, Saitama, Chiba, Aichi, Kyoto, Osaka, Hyogo & Fukuoka, while active in 27 of the 47 prefectures, including the Okinawa Islands

>30k restaurants signed up as of Q2 2020, so roughly in line with Demae-can at the time

Recently rolled out a ¥980 per month subscription offering, whereby the subscription covers delivery fees on all orders >¥1,200

Anecdotal third-party insights from an Uber Eats delivery person suggests a 20 min delivery brings in ~¥450 (~$4.30) & on a rainy day (i.e. high demand), one can net $65 to $85 working from 12PM to 10PM more or less straight. For some context, working as an employee of Demae-can for a maximum 9-hour daily shift, one will earn ¥9450 ($91), without the need to rent / own an electric bike (FYI note: tipping is not practiced in Japan)

The meaningful number of other food delivery players in Japan are all sub-scale, niche focused, non-core and / or incumbent brick-and-mortars with limited technological know-how:

Rakuten Delivery - big name, but a seemingly low priority for Rakuten

Foodpanda by Delivery Hero - Launched in September 2020 in prominent cities (i.e. Kobe, Yokohama, Nagoya, Sapporo, Fukuoka & Hiroshima), but not core Tier 1 cities (i.e Tokyo, Osaka, Kyoto). Large, sophisticated parent company, though difficult to identify their “edge” at this point in Japan

Wolt - the Finnish based company launched in Japan in May 2020. May surprise with apparent “niche” quality focus + relatively fresh $120M investment from strong backers. 75 employees today & apparently thousands of restaurants signed up. While Wolt & Foodpanda will surely offer subsidies to drive sign-ups & GMV, it may prove fruitless vs. deeper pocketed, home-grown SuperApp LINE

DiDi Food - The likely-to-IPO-at-a-$60B-valuation DiDi of China. Launched in February of 2020 & only in Osaka. Likely a low priority “side-show” to the group’s bigger China based opportunities

Docomo’s D-Delivery - dominant mobile phone carrier’s food delivery service. Non-core business, though it has been & still is, in fact, operated by Demae-can since its launch in 2014

maishoku - seems highly geared towards foreigners. Sub-scale, <1k restaurants

Chompy - appears to be very early in its development

JBI Note: The last competitor we’ll mention is Ride On Express Holdings (love the name!). We specifically pull this one out from the rest as it is an interesting asset (*M&A target*) with a business model that nicely overlaps with that of Demae-can. In brief, the company owns three delivery-only restaurant brands - effective cloud kitchens - which primarily focus on sushi (~$550M delivery market, trailing only that of pizza in Japan) & kamameshi (a traditional Japanese rice dish, ~$45M delivery market). In these two “niche” food delivery categories, they enjoy a 51% & an 82% market share, respectively. Ride On today operates 740 stores (266 directly managed, 474 franchised) which are located in 364 non-prime real estate locations (102 directly managed, 262 franchised) & are each staffed with 20-30 employees who manage orders, prep food & handle deliveries. The aim for each location is to address a ~50k household population within 30 to 40 minutes. Lastly, an emerging business within the group is their fineDine unit, which is directly comparable to Demae-can’s Sharing Delivery business (though far smaller in size & focused primarily on upscale restaurants). fineDine currently partners with 780 affiliated restaurants to provide outsourced food delivery services.

While we can’t speculate too deeply around the merits of building vs. buying at the moment, on the surface, Ride On would appear to be a very compelling acquisition target for Demae-can. Demae-can could very quickly broaden its traditional Japanese food offerings with two dominant delivery-only brands, and, perhaps more importantly, they can quickly acquire established “cloud kitchens” all around Japan. Notably, Ride On presently trades at ~0.55x to ~0.65x EV / NTM revenue & ~1.2x to ~1.3x EV / NTM gross profit…not too expensive given the likely Day 1 synergies.

Recent Valuation Spike Doesn’t Dent Significant Room For Further Compounding

We’ll address these last two sections as we do in our “JBI Notes”

As noted in our intro, while Demae-can’s medium-term goal is to “make restaurant food deliveries an everyday occurrence”, the company’s ultimate aim is “to establish Demae-can from a simple delivery service to a life infrastructure that is indispensable to Japan”. While ambitious visions & powerful narratives are important for companies seeking to redefine industries - be it to better attract the best investors, most funding, top employees & partners and / or to dominate mindshare among potential customers & competitors alike - fundamentals still do matter at the end of the day.

When we take a look at Demae-can’s enterprise value over the last five years, we see a clear upward trend until, we’d argue, Uber Eats began to make serious waves in Japan beginning in late 2018. Not until LINE’s investment was finalized in April 2020 do we see a sharp reversal of that downward trend, which has since culminated in Demae-can’s share price rising >4x, giving the company an enterprise value of ~$2.3B today.

As there is just one analyst covering the stock, “street estimates” are of little value, so let’s instead rely on management’s guidance to put some context around the current valuation.

Looking out what is effectively 2.5 years from today to August fiscal year end 2023, the company is arguably quite “cheap” on a TEV / estimated revenue basis, at a mere 2.4x. If we trust management’s FY23 projected operating margin of 12.4%, the business is selling at a not-too-crazy 19.8x EV / FY23E EBIT multiple.

Taken a step further, with some relatively arbitrary, though nonetheless conservative, estimates for those investors fortunate enough to be able to operate with, say, a five year time horizon, we end up with the following valuation metrics. Assuming an improved operating margin of 20% by FY25E, we are looking at a ~7.3x EV / FY25E EBIT multiple

One final take will have us look out to fiscal year 2030, where we don’t feel it is too farfetched to assume that Demae-can will by that point effectively “own” the “on-demand” food delivery market in Japan, thereby allowing for a potential >10x return from today.

While there is certainly merit to comparing Demae-can’s financials, growth rates, valuation & the like with global peers, we’ll refrain from going through that exercise here…largely because this post is already way too long. We will note, however, that Doordash is looking to IPO at a fully diluted market cap of ~$35B within the next few days. It wouldn’t shock us to see this valuation jump to $40B to $45B once live-trading. Since we used a TEV / Revenue multiple above (note: we’d actually posit that a TEV / Gross Profit valuation metric is best, particularly when comparing across peers, as GMV - and thus revenue - can be “gamed” / boosted via gross profit negative customer subsidies. While over the short-run this can be a powerful competitive tool to grab market share for a company backed by deep, strategically aligned & patient pockets, it is nonetheless unsustainable over the long-run in our view. Anyways, back to Doordash’s IPO valuation…)…on a TEV / NTM revenue basis, Doordash is very likely to be valued somewhere in the range of 10x to 15x…in a U.S. market that still requires further consolidation for likely sustainable industry-wide profitability, while growing at a slower, more normalized post-COVID grow rate, well below that of Demae-can’s “embedded-within-a-SuperApp” >100% projected growth for the two next years.

So, in sum, how do we think about Demae-can at today’s valuation?

We’ll answer that with the following three thoughts:

1) We today see plenty of other more richly valued technology companies - be it in the Japanese market or elsewhere - offering far less growth with much less of a competitive “moat”, playing in markets a fraction of the size of Demae-can’s.

2) When a uniquely positioned, high-potential company playing in a large, rapidly transforming market goes through a significant de-risking event - such as with LINE investing in & now effectively running Demae-can - shares of the business may immediately jump to reflect this positive development. However, we’d argue that, in many cases, the resulting impact to the investment’s downside risk profile & subsequent probability weighted upside scenario(s) nonetheless warrant a step-function jump in conviction & position sizing, to the extent possible, for the long-term oriented investor. In such cases, present day investors are still often grossly undervaluing the long-term potential & ultimate size of what is likely to become a category-defining company. Of course, it is important to realize that one is “buying” the presumed durable future compounding of the business here, not a mispriced asset based on current or near-term fundamental metrics.

3) While the core food delivery business still has a lot of room to run in the near-term for Demae-can - unlike what some could argue is the case for its more highly penetrated global peers like Doordash in the U.S. - the long-term bull case for really any food delivery business today is expanding the depth & breadth of its “total reach”. Whether that be increasing attach rates among merchants by broadening their merchant service offerings (some of which, mind you, require scale to adequately roll-out and can help to meaningfully drive a positive “flywheel" of further merchant growth over time…look no further than Shopify for a brilliant case study here) or jumping into adjacent verticals, such as convenience store or grocery delivery.

A great example of the former would be goPuff, which delivers “convenience store” products like OTC medicine, alcohol & quick-grab foods in <30 minutes. Given the opportunity in that space, the company recently raised $380M at a $3.9B valuation from Accel, D1 Partners & Softbank. Doordash is hot on their heels with their own recent launch of Dashmart in August 2020 with partnerships with 7-Eleven, Walgreens, CVS & Wawa.

Yet another example in how Demae-can - and again, really any food delivery company - can “deepen” its existing profit pool is following the playbook of Zuul Market. In short, Zuul offers a curated mini-marketplace of local restaurants matched with the aggregated demand of a commercial or residential landlord’s specific, localized tenant base. Given the far more efficient ordering & batched delivery approach of this model, the cost of delivery in high density areas - so, >75% of the entire Japanese population - drops tremendously (hello profits).

Be it any of the above, merchant advertising as we see with Meituan or something not yet thought of, Demae-can & all other leading global food delivery companies need to ultimately push towards an “Act II”, whereby they can increase a combination of i) average order values; ii) average order frequency; iii) merchant & consumer attach rates with additional value-add, ideally higher margin, offerings; and / or iv) logistics & delivery efficiency. In Japan, with Demae-can now an effective extension of “SuperApp” LINE, the company is by far the best equipped to execute & succeed in this regard.

To close out this section, as we sit back & reflect some on this particular opportunity, a couple of quotes pop to mind:

1) An insight shared by one of our favorite investors, Brad Gerstner of Altimeter Capital, during a recent interview when he was briefly discussing Snowflake:

“I wouldn’t pay that much attention to the next twelve months. You & Cramer like to talk about 100x sales. But when you are analyzing a company that’s growing over 100% with such low penetration of its TAM that this company has, you really need to look out three years to figure out what you’re really paying for the business. Compare the multiple three years from now with the multiple of the rest of the software complex, and it looks far less onerous.”

2) “Charge low fares, get more people to fly, get them to fly more often, and you will produce the best return to shareholders.” - Herb Kelleher, former CEO of Southwest Airlines

While not an apples to apples comparison between business models, the “flywheel” referenced here with regards to discount airlines, we’d argue, also applies to food delivery in a lot of ways. The biggest caveat being perhaps Demae-can’s ability - or that of any other food delivery company - to “charge low(er) fares”. In reference to this, it must be mentioned that Doordash’s DashPass had 5M active subscribers as of September 2020, equating to $600M of run-rate revenue. This subscription offering, alongside other platform add-ons, have enabled DoorDash to drop consumer fees by ~20% since 2H2017…so, perhaps it is possible to indeed “charge low(er) fares” over time.

We’d also advise readers to remember that we are still in the early innings of digitizing the world around us, with consumer & business behaviors ever more quickly adapting to this fast-changing environment. A bit of imagination & patience is needed from the truly long-term investors, particularly so in an investment environment where “venture investing in public markets” may become more of a reality than we currently anticipate & have ever experienced before. Don’t forget as well that while the food delivery market is enormous in and of itself the world over, some of the leading companies in this space believe they are “transforming the future of local commerce” & becoming the white-labeled delivery platform for the offline world…a market that is multiple times larger than food delivery alone:

“Over time, as DoorDash partners with local businesses beyond restaurants, we want to make it easy and affordable for consumers to enjoy the best of their communities…To date, these deliveries come primarily from restaurants. In the future, we envision this membership program becoming a wallet for the physical world, where a consumer can access not only restaurants, but all the local businesses in their community, and receive benefits while shopping in-store, at home, or anywhere in between.” - Tony Xu, Founder & CEO of Doordash

Further Diligence & Questions Remain

To snap back down to earth now, there remains a good bit we’d still like to further research & dig into regarding Demae-can. Several of these topics & questions include:

Culturally speaking, to what extent can food delivery truly be “a thing” in Japan?

Food delivery demand in Japan has historically been more so tied to “special occasions”. In comparison to Western cultures, for example, the prevalence of dual-income households and whether people make a habit of cooking on weekdays is different enough in Japanese society to give some pause in applying broad-based demand curves & penetration rates from other developed markets within Japan.

Ubiquitous convenience stores - or “combinis” as they are called in Japan - are highly frequently, very affordable, offer wide food & beverage selections & are, quite frankly, some of the strongest competition to food delivery more generally

Tied a bit to the above, a better understanding of the qualitative & quantitative factors supporting physical Sharing Delivery bases & the general attractiveness of the full fledged logistics delivery model in Japan…a country with stagnate wage growth (good for labor costs, bad for delivery demand), where land is limited & neighborhoods are thus usually “densely packed” (good for a logistics approach), though also where public transport is very commonly used with many local grocery stores, convenience stores & nearby restaurants making it an easy, daily habit of sorts to “grab-and-go”

We briefly flew around this topic in the last section, but the sustainability of current fee / pricing levels for Demae-can & really food delivery companies globally. In the U.S., there is more than one local government sounding the alarm on what they deem to be excessive fees. Regulation more generally is a concern, particularly in regulation-heavy Japan.

Degree of supply-side pressure. As of now, we actually don’t think this is a huge threat given what we believe to be the far greater proportion of independent restaurants in Japan vs. chains (vs. the U.S.), but we’d nonetheless like to dig deeper here

We’d absolutely love to see customer cohort data from Demae-can, at least as much as that shared by Doordash in their S-1:

Relatedly, a deeper analysis of per-order & cohort-level contribution margins

The persistent labor constraints within the Japanese economy will likely make it a difficult ongoing task to maintain sufficient delivery personnel staffing, while general wage stagnation could limit the addressable market size & subsequent AOV ceilings

While company fundamentals are baseline critical, an examination of overall market fund flows & a company’s shareholder base matter today more than ever. To that end “strategic entities” own ~65% of Demae-can today, while long-term, sophisticated international institutional investors - such as Ballie Gifford, Wellington, T. Rowe Price & Fidelity - hold another ~12%. As a fast-scaling “category-winner” in Japan, we’d imagine analyst coverage will greatly increase, and that both domestic & international investors will continue to grow their exposure to such a high-growth Japanese name. We would also not be surprised to at some point see LINE attempt to buy-out the ~40% of the company it does yet not own.

Noting here is investment advice, do your own research, no position but may in the future

Great post - I wonder if you'd be open to a call about some of the businesses you've written about (and a few others!)?

If so, what is the best way to get in touch?