Today's Software PE Opportunity in Japan: PIPEs > Growth Equity > LBOs...Tee'ing Up A One-Day "Roper of Japan"

An engaged "private equity in public markets" approach offers up the most sizable, scalable & actionable private equity opportunity today in Japan's burgeoning ~$108B software market

TLDR

The Japanese enterprise software market is the second largest single nation TAM globally after the U.S., topping out at ~$108B

Private equity as an asset class remains an “emerging” industry in Japan, with private equity investment representing ~0.2% of GDP vs. ~3.2% & ~2.4% in the U.S. & Europe, respectively

While indeed viable, leveraged buyouts & private market growth equity investments among Japanese software companies are much “easier said than done” for the foreseeable future. This is due in part to a mix of cultural complexities, degree of industry maturity & software company composition, which, among other factors, combine to greatly limit the viable universe of sizable, attractive & actionable investment opportunities today

Longer-term oriented “friendly consultavism” (h/t Miri Capital) via PIPEs & meaningful minority stake open-market purchases offers the most practical, scalable & robust “private equity” investment strategy within the Japanese software space both today and likely for the next 5+ years

Once the Japanese software private equity space reaches a more “mature state”, building the “Roper Technologies of Japan” is likely to provide early investors with one of the most reliably compounding, highest-returning and best risk-adjusted levered equity return profiles available across the global software landscape over the ensuing few decades

The Japanese Software Opportunity: an Existing ~¥12T (~$91B) Revenue TAM

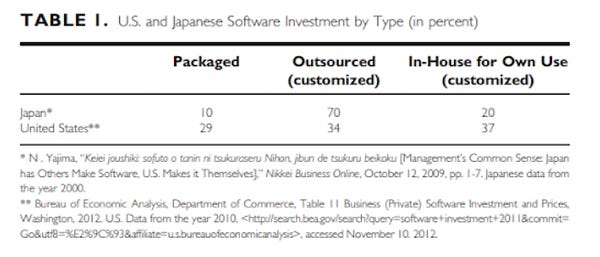

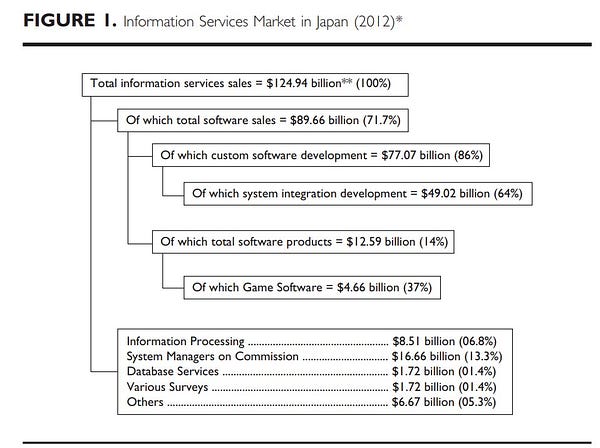

According to Japan’s Ministry of Economy, Trade & Industry, the Japanese software industry today is characterized by the following statistics:

In English & after pulling some additional data from the above hyperlinked report, my below tweet summarizes some of the key highlights:

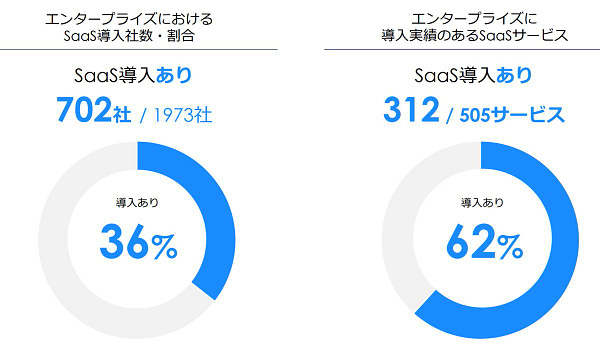

In my last post - The Globally Unique Opportunity For B2B SaaS Incubations in Japan - I also shared some relevant figures regarding the size of Japan’s enterprise software market, as presented by Japanese venture capital firm, One Capital. I’m pasting below one of the more relevant charts:

Suffice it to say, the Japanese software market is already enormous…yet still very much under-penetrated when it comes to the adoption of modern cloud SaaS products.

A “Still Emerging” Asset Class: Private Equity in Japan

Interestingly, the size of the Japanese private equity market as a percentage of Japan’s GDP significantly lags the equivalent statistic for the U.S. & Europe by a factor of ~16x & ~12x, respectively:

This seeming aversion to private equity in Japan is partly due to the historical negative associations tied to the industry (i.e. “Barbarians at the Gate”) among Japanese business executives & owners. This perception has certainly improved over time, though there remains a ways to go before a “full embrace” by Japan Inc. & the SMBs comprising the “backbone” of the Japanese economy.

Another apparent obstacle holding back the private equity industry in Japan is the relatively low participation of pension funds as LPs. Across the entirety of the global private equity space, pension funds represent almost 50% of LP capital. In Japan, this group of investors accounts for a mere ~15%, with corporate investors & banks equating to a combined >50% of LP capital. These two latter investor profiles are arguably less attractive as LP partners across a variety of measures, with (a more limited) capital capacity, (a lower) degree of commitment & subsequent (shorter) investment time horizons being some of the more limiting factors.

It is worth mentioning, by the way, that the world’s largest pension fund is Japan’s Government Pension Investment Fund, or GPIF. The fund has ~$1.7T in assets, though has a mere ~$75B (~4.5%) earmarked for potential alternative investment allocations. In reality, however, GPIF has allocated a paltry 0.92% of assets, or ~$15B, to alternatives today. That said, there is ongoing, relevant progress being made in this regard, such as the January 2022 appointment of Mitsubishi UFJ as the fund-of-funds manager for GPIF’s increasing focus on private equity investments. As a result of this & other related efforts, we are likely to see a steady rise in GPIF’s alternatives allocation, though I suspect the uptick will be far more measured & ultimately lower than some may hope.

More broadly, the fast-growing number of aging Japanese CEOs, business owners & employees at large requires a need for greater capital efficiency & overall productivity increases throughout the Japanese economy, something private equity investors should be well equipped & incentivized to support. In addition to this, there has been a strong push recently by the Japanese government to restructure the oftentimes complex cross-holdings & bloated subsidiary rosters of large Japanese companies (thereby driving corporate carveouts). These two factors, among many others, provide a growing tailwind supporting further private equity investment in Japan over time.

A “Just Emerging” Sub-Asset Class: Software Private Equity in Japan

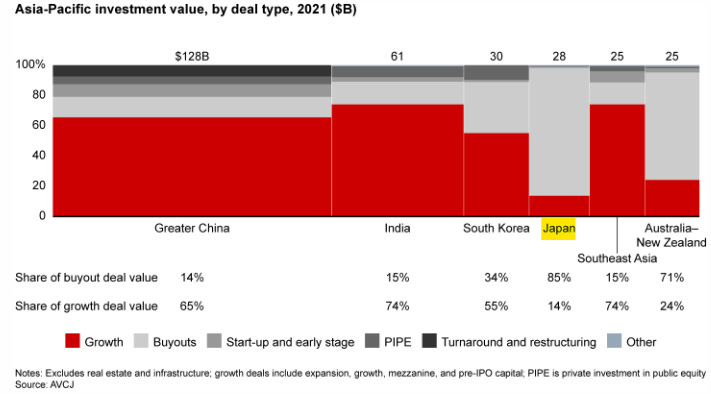

Looking at data for 2021, buyout deals represented 85% of Japanese private equity investment value. Growth deals, on the other hand, represented a mere 14% (~$3.9B), the lowest such percentage among all regions in the Asia-Pacific. Of course, it makes sense that buyouts account for a significant majority of total private equity investment in Japan today when one considers i) the largely government induced push for corporate restructurings; ii) the ample and relatively cheap debt financing available; and iii) the >50k companies in Japan with >$25M in revenue, which is roughly the same number as those throughout the rest of the Asia-Pacific region, excluding Japan. While likely accurate to a degree, I assume many will also point to Japan’s declining population and slowing economic growth as a further justification for why private equity growth investments are more rare versus buyouts.

For simplicity’s sake, we can probably safely assume that a good chunk of that 14% of growth deal value is pre-IPO equity & mezzanine debt capital, as well as likely oriented to verticals beyond just technology & software (i.e. consumer, industrial). So, let’s conservatively call it 5% (~$1.4B) of all deal value in Japan being technology focused growth deals in 2021.

A question worth asking then is whether growth investments in Japan, and specifically those in the technology vertical, will ever gain relative share vs. buyouts to match that of, say, Australia-New Zealand (24%), at the very least? Tough to say for sure, though if we make the leap of faith that technology focused LBO + growth equity capital deployed even just forever trails the amount of venture capital deployed in Japan (mind you, global VC AUM is 1/3 the size of global private equity AUM, while there is >$210B in AUM between just two U.S. based, software focused private equity firms, Thoma Bravo & Vista Equity, equating to ~10% of total worldwide VC AUM), we should see a meaningful jump & ongoing growth in the absolute dollar amount of technology growth investment deal value in Japan (~$1.4B : ~$7.1B of Growth Tech : VC in 2021).

Willing to take the above leap of faith and with a personally more optimistic long-term (~25 years) outlook on Japan’s potential immigration, economic growth & cloud software adoption trends (note: an outlook that is more optimistic than current consensus. I do not expect Japan to become the “next India”…but more on that another day!), I’d argue there exists today a significantly under- / mispriced, long-dated “call option” available to investors, entrepreneurs & knowledge workers alike willing and able to firmly position themselves ahead of these potential, gradual macro inflections and, more importantly, the relative explosion almost certainly to come in software focused growth capital & incremental SaaS penetration / adoption over the coming decade(s) in Japan. While we are already seeing this relative explosion in venture capital formation in Japan in recent years (refer to above chart), there’s yet to even exist a dedicated software private equity firm in Japan.

Excitingly, though, front-page software private equity deals are slowly starting to emerge in Japan. Take KKR’s March 2022 corporate carve-out acquisition of SMB focused accounting software provider, Yayoi. Yayoi directly competes with two of Japan’s more well-known & higher quality publicly listed SaaS companies - and favorites among international growth investors - freee (¥160B EV, ~8.9x EV / NTM revenue) & Money Forward (¥195B EV, ~7.9x EV / NTM revenue).

Notably, this was no small deal. The sale price landed at ¥240B, or $2.1B at the then USDJPY exchange rate, up from the ¥80B (3x) that now former parent company, Orix, acquired the company for in 2014 (quick aside: Intuit actually spun-off Yayoi in 2003). For the fiscal year ending March 2021, Yayoi enjoyed profits of ~¥6B, while revenue clocked in at ~¥20B in the year ended September 2020. Making some conservative growth assumptions & triangulating to a very rough approximation of the deal’s potential NTM revenue & LTM net profit multiples, we can probably assume KKR paid somewhere around ~8.5x & between maybe 30x to 35x, respectively. Informed guesses, but guesses nonetheless, for what appears to be a rather “full” price for such an asset acquired by a generalist investor.

I won’t walk through the details, though Carlyle’s April 2016 acquisition and subsequent March 2021 listing of Japanese software company WingArc1st (~¥70B, or ~$520M EV) is yet another supporting data point.

The primary purpose of mentioning these two deals is to highlight that we are just beginning to see an emerging appetite among some of the more well-known, sophisticated private equity firms in Japan to acquire sizable domestic software companies, alongside a similarly encouraging sign of Japanese software company owners & management teams viewing private equity as an attractive investor-partner.

A Ways To Go, Though An Increasingly Target Rich Pool of Potential Investments

Admittedly, I’m oversimplifying and, unfortunately, don’t have much in the way of hard data to support the following characterizations; nonetheless, I’d posit that most all Japanese software companies today fall into two broad buckets:

Profitable, “old school”, predominately custom-build & on-prem “slow-growers”

Unprofitable, “modern”, VC-backed, “shoot-for-the-stars” SaaS startups

Regarding the former, a typical software company in this group will likely be significantly family owned & operated - even if publicly listed - founded in the 1980’s, 1990’s or early 2000’s, bootstrapped ever since & deeply entrenched with its long-standing customer base (note: a broader observation re: software in Japan - one which I am eager to further quantify & verify with industry-wide historical data - is that fully burdened CAC tends to be consistently higher & gross churn lower, in aggregate, in Japan vs. other developed markets like the U.S. Qualitatively, cultural realities (e.x. “okyakusama wa kamisama desu” = “the customer is god”) & current market maturity (e.x. relative dearth of account executives deeply experienced in selling modern SaaS applications who have been able to “cross-pollinate” software companies as they job-hop) primarily drives this. However, I’m not entirely sure the degree to which this is actually the case). In a good number of instances, the company will have evolved from, and may in fact still continue to be, an effective “dev-shop” or small-scale system integrator of one sort or another (i.e. so not always a “pure-play” vertical market software company, the likes of which Constellation Software typically acquires). The company is usually profitable (sometimes due in part to below market salaries paid to now tenured employees), is likely worth well below $500M in enterprise value and sporting a UI / UX that doesn’t appear to have been updated since Y2K with its software built on .net or COBOL. With business succession a growing issue in Japan more generally, software companies of this type should represent a compelling pool of potential buyout targets, though the post-acquisition “hairiness” (i.e. difficulty recruiting new talent, significant technical debt, growing competitive shortcomings & subsequent up-hill battle to re-accelerate growth, etc.) will require a very strong operational playbook and / or a unique investment approach from the outset (i.e. Constellation Software-esque).

With regards to the latter, these are your hopeful high-fliers, founded over the last decade plus and primarily staffed with Millennials & Gen Z employees. In many cases, these businesses are unprofitable or, at best, barely profitable, usually chasing “white-space” opportunities without yet a strong focus on durable, economically sound growth. They are often backed by VCs & running the “VC playbook” to a likely disappointing future outcome (i.e. no IPO) that few of these younger Founders have yet to accept today (in part because an IPO is still commonly viewed as the, far and away, most desirable “exit” scenario in Japan).

—

As a quick aide…to provide some additional context around this last point, the Japanese start-up ecosystem is still relatively immature & emerging (vs. the U.S.), with the number of (quality, let alone repeat) entrepreneurs being the largest bottleneck. As a result, the diversity of thought regarding technology company building (& the lack of existing alternative capital providers designed to support any “diverse” building strategies) still tends to be largely one-dimensional (i.e. “If I seek to build a SaaS company, I must raise venture capital & attempt to build a unicorn that IPOs”). Among other tactics, current & future founders of Japanese software startups need to be better introduced to & educated on the various alternative paths to & definitions of “success” that exist beyond those that involve venture capital & IPOs. The mere acknowledgment of & increasing comfort with a viable “Path B” among startup Founders is likely to itself slowly “seed” the market for future software private equity deals in Japan.

—

To return to the “older, slower growers” category, the below, (very) select list of publicly listed Japanese software companies should give you a better sense for the scale, current valuations & types of potentially interesting buyout targets today:

On the private side, there is undoubtedly a much larger universe of (primarily quite small) software company targets. More specifically, recall the ~15k active software companies in Japan per the METI report discussed earlier in this piece. Also as noted earlier, anecdotal evidence suggests a meaningful percentage of private software companies can be aptly described as quasi-development shops or smaller-scale “system integrators”. Regarding the latter, a number of these outfits usually act as a sub-contractor to a larger system integrator - sometimes with another mid-sized sub-contractor in between - who maintains the direct customer relationship. As a result, for most of these lower-rung, sub-contracted, small “system integrators”, profits can sometimes be elusive.

Unfortunately, gaining further insights into this pool of private software companies is difficult without actually getting out “into the field” and talking with operators and business brokers.

On the other hand, we do have a bit more transparency into the much smaller, though burgeoning world of “modern” SaaS startups. For example, below are two market maps detailing the full extent of the horizontal (~325 companies) & vertical market (~116 companies) SaaS startups in Japan as of 2021 (source: One Capital):

It is probably safe to assume that 95%+ of these venture backed software startups are not actionable buyout nor growth equity investments today. However, over time, I suspect a growing subset of companies in this fast-growing pool of software startups will emerge as attractive “busted” VC investments, where the Founders & VCs will seek a relevant investor-partner to finance a more modest go-forward growth path & provide a meaningful dollop of liquidity to a likely then fatigued Founder(s) & eager-to-move-on VC.

Ultimately, what Japan arguably needs more of are software companies that ideally fall between the “older, more rigid, slow growing, yet profitable” cohort & the “younger, unprofitable, shoot-for-the-moon SaaS startups”. That mix of more dynamic, forward-looking tech talent with a greater appetite & ability to innovatively adapt, paired with increased business maturity & greater execution discipline should help to create a more attractive, scalable & actionable opportunity set for the software private equity industry more broadly in Japan.

PIPEs > Growth Equity > Leveraged Buyouts

For purposes of this post, I’ll boil down the core private equity investing strategies into the following three approaches:

Leveraged buyouts (e.x. Thoma Bravo)

Growth equity (e.x. JMI Equity, Insight Partners)

Private investment in public equity (“PIPEs”) / “Private equity in public markets”

As I’ve widely referenced them throughout this piece already, I’ll assume the first two strategies are well understood by most readers. It is most likely also the case for PIPEs, though I do want to acknowledge that the “private equity in public markets” approach has both active practitioners and staunch critics. Also very aware that the powerful benefits of control investing in private equity are all but non-existent when acquiring a minority interest, especially so in a public equity.

As I will further elaborate upon shortly, I believe that PIPEs / “private equity in public markets” - not leveraged buyouts or growth equity - is the optimal “private equity” investment strategy within the Japanese software industry both today & for the foreseeable future. This is not to suggest that LBOs or growth equity opportunities are non-existent, woefully unattractive nor impossible to execute, but rather that a confluence of Japan specific realities - some of which I’ve briefly touched on above and others more below - make the two more common approaches less actionable, comparatively less attractive on the whole & meaningfully harder to execute than PIPEs / “private equity in public markets”.

Software LBOs: Great On Paper, Less So In Practice Today

At its core, a key element of a leveraged buyout is cost optimization, with headcount reduction being one of the primary levers. In Japan, headcount reduction can often be a non-starter:

Japanese labor law is very protective of employees’ rights. While it isn’t impossible to fire an employee on a contract without a fixed term (a lifetime employee), it is very difficult.

…in general, the company must prove four things before it can fire an employee. First, the company must show that the firing is a result of unavoidable economic necessity. Second, the company has to try to reassign employees to different positions to avoid the need to fire them. Third, the employees to be fired must be selected reasonably and the firings carried out fairly. Finally, the process must be reasonable and the company is expected to consult with workers and labor unions beforehand

…In practice, workers are rarely fired in Japan. - Ohara & Furukawa Law Firm

That notwithstanding, let’s say you LBO’d a Japanese software company and were able to “encourage” some voluntary retirements. Now, you want to “level-up” the company-wide talent a bit. Well, first off, you’re contending with a declining & aging population in Japan, with most young professionals flocking to large urban centers, alongside a current 1.24 job offers per job seeker ratio. Hiring any talent - let alone quality tech talent - at what is often going to be a rather old, smaller-scale, slow-moving (all-around) LBO’d software company is going to be difficult, to say the least. Not to mention the fact that raising salaries above the existing, likely below-market, wages the company is paying its presently tenured, say 40 to 70 year-old, employees in order to attract this new talent will not only whack the juicy profit margins that attracted you to the business in the first place, but will also upset the internal harmony among the “new & old” when such pay discrepancies inevitably “leak”. While we’re at it…it is probably safe to assume that the odds of working with or hiring a truly adaptable, aggressive, dynamic CEO / management team - the likes of which Thoma Bravo tends to heavily lean on in generating its returns - at this likely smaller-scale (<$500M EV) software company is low to quite low. And this, of course, is all assuming you can even find a suitable target company and then convince a likely ~60+ year old Japanese company Founder & CEO to sell to a traditional private equity firm (remember…“the Barbarians at the Gate"), let alone at a price that he or she is not (irrationally) benchmarking against the far faster growing, publicly listed Japanese SaaS companies he / she reads about in the Asahi Shimbun.

As a result, the core bet one is likely making here among the large majority of potential software private equity buyouts today is that of a low-cost (i.e. low interest), highly levered acquisition of a slowly less defensible bond-like cash flow stream, ideally acquired at a bargain purchase price that can, at some point, be “flipped” as a bolt-on to a larger (likely non-software) corporate buyer or maybe (re-)IPO’d where the private equity firm will then likely end up being a very substantial holder of a rather illiquid, micro-cap security (<$500M market cap).

Am I being overly pessimistic here? Yes, a bit. There’s no doubt some very compelling investment returns can be generated via software LBOs in Japan on a deal-by-deal basis. However, how scalable & repeatable is the strategy across an entire portfolio today? Not to mention the underlying risks implicitly being assumed in a market where the “exit depth & diversity” is still lacking with increased competitive threats (i.e. happily unprofitable VC funded SaaS startups) only just beginning to proliferate? Tough to say, though I suspect it looks better & and is easier to execute on paper for the time being.

Software Growth Equity: Getting There, But Still A Ways Off

Personally, I find this approach to be more exciting, if only because of the ability to work with usually younger, more adaptable Founders / CEOs and more modern tech stacks, coupled with the opportunity to more aggressively & confidently build in the still wide-open white spaces of Japan’s vertical market SaaS opportunities.

On the other hand, some of the biggest barriers today to scalable execution with this investment strategy are:

Relative dearth of sizable (>$10M ARR), growing (>15%) software companies

Relative dearth of Founders not interested in or unable to pursue an IPO

Significant Founder equity ownership across all company age cohorts

Lack of (quality & sizable) M&A exit opportunities

Regarding the third point, Founders of more modern Japanese technology companies have generally remained significant equity owners to-date, even after several rounds of venture funding and / or several years post-IPO. There are a variety of reasons for this, though two of the more relevant have been an historical lack of (primarily later stage) growth capital & non-economic motivations unique to Japan that encourage early IPOs (i.e. supports credibility & reputation among potential customers, partners & employees). To drive home this point, below is a chart of various Founders’ current equity ownership stakes among some of Japan’s more innovative, leading, publicly listed technology companies today:

First and foremost, such a degree of alignment among true owner-operators is incredibly exciting to see! Conversely, with such strong grips on their companies, it makes it imperative to have Founder buy-in for any sort of significant private equity transaction. The situation is almost certainly very similar among mid to later-stage private SaaS startups, where Founders - versus venture capitalists or other private equity firms - are even more likely to own the lions’ share of equity and thus remain the key decision-maker(s) in the board room.

As a result, the ability to successfully execute any form of software growth equity in Japan today - especially where majority control is the aim - is intrinsically & critically tied to the private equity firm’s ability to initially build relationships with Founders & their subsequent ability in convincing those entrepreneurs to transact / sell. Of course, this reality still generally exists in the U.S. in a meaningful way, however, a majority sale to (a now rather diverse range & significant number of usually very eager) private equity buyers has:

Ample precedent at this point (i.e. U.S. software companies are even passed among private equity firms these days)

Is very much a "socially accepted” form of success for a software company Founder(s), something that is not yet as celebrated in Japan; and

Is oftentimes now the only real option, as IPOs of smaller-scale companies are uncommon in the U.S. (unlike in Japan) & larger corporate buyers frequently prefer acquiring a “cleaned-up” software company from a private equity firm (e.x. Roper CEO: “everything we buy is from private equity” & below):

Moreover, publicly listed software companies in the U.S. often see Founders & management teams today owning single digit percentages of the company, with usually more diffuse Boardroom control. So, while Founder support for a deal is certainly desired among U.S. software private equity buyers, it is not necessarily as critical - or even relevant in some cases - for a meaningful percentage of investments. This is simply not the case today in Japan across a significant majority of software companies.

Couple the above with the fact that most modern-day Japanese SaaS companies of any modest scale, again, tend to IPO quite early (note: the current median & mean market cap for Japan’s publicly listed SaaS companies are $199M & $460M, respectively), and we can then rather confidently suggest that there are very few public, let alone private, more growthier, dynamic software companies today of any really meaningful scale that likely check the initial boxes for a truly viable growth equity investment candidate (let alone any SaaS companies, period, who can act as more prolific, sizable acquirers themselves). As a result, one is confronted with a rather constrained “investment TAM” at the moment with a predominately one-dimensional exit strategy (i.e. (re-)IPO) if primarily pursuing a software growth equity approach focused in the private markets, regardless of it being a majority or minority ownership transaction.

Note: left side is Japan, right is the U.S. E.x. in 2019, 32% of startup exits in Japan were M&A, while 91% were M&A in the U.S.

Worth highlighting, there are indeed sizable late-stage venture investments into software companies occurring in Japan today. Preeminent recent examples include SmartHR’s $143M Series D with investors like Lightstreet, Sequoia Capital Global Equities & Whale Rock and Sequoia Capital investing in Andpad’s ~$50M Series C. However, these late-stage private SaaS investments by largely “hands-off” investors do not exactly fall in the same bucket as those executed by U.S. software growth equity investment firms, such as JMI Equity (e.x. SafetyChain Software’s $50M minority growth investment in October 2021). Perhaps splitting hairs some, though the approach to software growth equity investing I am specifically referring to is more akin to the latter (i.e. JMI) and less so the former (i.e. cross-over hedge funds).

PIPEs & “Private Equity in Public Markets”

So, if we assume software LBOs & private market growth equity investments are “easier said than done” in Japan at present - and likely the same for the next 5+ years - then what is the optimal private equity strategy today if one is seeking to tap into the already large, though increasingly dynamic, evolving (into SaaS) & still expanding Japanese software market in a more directed & substantial fashion than as a mere passive public markets investor?

One answer - the one Thoma Bravo & Vista Equity will likely abide by - is to simply wait it out. Understandable for them, though not exactly necessary - and maybe even unwise - for a smaller, less established, de-novo and / or to-be-launched private equity firm with aims of building a reputation as the software private equity specialist in Japan…a moniker yet to be bestowed upon any investment group to-date.

To do so in the here & now, however, pursuing an investment strategy that primarily relies on PIPEs and sizable minority ownership stakes (acquired via open-market purchases) in publicly listed Japanese software companies, accompanied by an engaged, active & friendly relationship with management, is the most actionable, scalable & attractive option. Among others, and including some discussed earlier, a few supporting perspectives for this view are as follows:

While slowly changing (e.x. SmartHR & Andpad) & as noted earlier, it still remains the case that a significant majority of Japanese technology startups / companies of any modest scale are publicly listed & IPO quite early in their lifecycle (refer to Mothers & JASDAQ data below; 2015-20 data per Japan Exchange Group; also, there are 3,830 publicly listed companies in Japan today). As a result, in terms of AUM scalability - both the size and pace of viable deployment - publicly listed software companies are really the only game in town for now (note: as a point of reference, and far from including all publicly listed software companies in Japan, One Capital’s Japan SaaS Index has an aggregate market cap of ¥1.6T today, or ~$12B).

While also slowly changing, the more ambitious, higher-quality & most forward-looking tech talent in Japan today still generally gravitates to the more established, credible, larger - and thus usually publicly listed - technology companies. Younger, talented Japanese professionals are gradually turning down lifetime employment guarantees & embracing more change & risk in their career choices, though this cohort of knowledge workers remains a small minority. As a result, competition for top tech talent is increasingly fierce in Japan, with larger, more proven and usually more resource-rich public tech companies offering the most social cachet & (coveted) job security & certainty (vs. private companies & startups…just as government employment still tends to offer more perceived social cachet & job security vs. jobs at “Big Tech” companies among new graduates in Japan).

Even among some of the larger Japanese SaaS companies with meaningful analyst coverage, I’d argue that the level / depth of consistent analytical rigor applied to analyzing these companies & their opportunity sets by both domestic & international analysts / investors alike (the latter of whom are usually quick to abandon Japan in times of market stress) is comparatively lacking relative to that applied to U.S. software companies. Similarly so - though to varying degrees - the strategic, operational, sales & product prowess of most Japanese software company management teams still has ample room for improvement to match those of the average U.S. software company management team (note: this is not a knock on the innate capabilities of Japanese software management teams; it is rather a statement about the relative maturity of the Japanese software / startup ecosystems in Japan vs. the U.S…time & further experience will change this). Point being, the opportunity for more exaggerated, less competed & more frequent mis-pricings (on both sides of “fair value”) of publicly listed Japanese software companies is arguably more pronounced (vs. in the U.S.), coupled with relatively more substantial, long-term, latent upside available via ongoing improvements in the quality & speed of company execution over time (particularly when aided by the, ideally, welcomed support of a friendly, engaged, committed “private equity” shareholder-partner).

Of course, there are numerous limiting factors when attempting “private equity in the public markets” as I’m suggesting here. For example, however friendly & informative one’s “best practice” guidance may be, the management team (which you almost certainly cannot (& really should not in Japan) replace in these instances) may lack the depth of commitment / belief / skills necessary to actually effect the desired change(s) & subsequently drive the financial outcomes you, the investor, are underwriting for your 20% 5-year IRR. Even so, the current market realities & still prevalent market inefficiencies make it such that this approach offers up the most attractive, actionable & scalable software private equity investment opportunity in Japan for the foreseeable future.

While not specifically software focused, a case-and-point example of a successful Japanese private equity fund that (fittingly!) supports this perspective is Advantage Partner’s recent ¥65.1B (~$500M) fundraise for its Advantage Partners Private Solutions Fund, a strategy targeting “private solutions” for Japanese publicly listed companies:

The APPS’ investment strategy is unique to the Japanese market as it pursues investments mainly in newly and privately issued convertible bonds or preferred securities of target companies. The Fund partners with investee companies by entering into business alliances with the companies to collaborate and provide proactive management support to achieve growth and increased enterprise value…

…We would like to contribute to the growth and regrowth of listed Japanese companies by fully leveraging the expertise and track record of the Advantage Partners Group…[and] support the various needs of Japanese listed companies, including: engaging in new business strategies such as M&A, overseas expansion, and new business expansion; broadening management perspectives…[etc.]

Currently, Advantage Partners has six active investments within this strategy, where they “acquire shares of listed firms and work hand-in-hand with company management to enhance corporate value”.

With such a sizable new fund from such a seasoned & reputable Japanese private equity firm effectively confirming the market opportunity for PIPEs / “private equity in the public markets” in Japan, it would appear that a similar, though initially much smaller, fund exclusively focused on listed Japanese software companies is potentially quite viable today for the “right” team of software investor specialists.

A Myriad of Ways To Support Enduring Value Creation

We could dedicate a whole post to this topic & many of its sub-topics, though for brevity’s sake, we’ll highlight a few key ways in which a hypothetical software private equity firm could specifically support its publicly listed software company management teams in Japan.

First and foremost, it would be essential that every investment be underpinned by an existing, expanding & healthy relationship with a potential investee company’s Founder(s) & other senior managers. Ideally, there will have been numerous formal & informal conversations between the two parties about the potential future of the company & much more by this point. In most all cases, a fully sized position in the portfolio - and all that comes with it - must ultimately be welcomed by the Founder(s) and investee company management team prior to acquiring the bulk of shares (in the case of a PIPE, this would be foundationally required). Once a full position is built, ways in which the private equity firm could specifically support a Japanese software company over the firm’s, say, 3 to 7 year hold period would include, but would not be limited to, the following:

Help develop and / or improve investor relation strategies & messaging, specifically for engagements & communications with international investors

Particularly in the very tight labor market for tech talent that is Japan, support “hiring as a science”, introducing concepts such as “employee NPS” (i.e. talent retention strategies), executive coaching (i.e. “up-skilling” executives, many of whom are “first-timers” and / or have not necessarily been “coached” in “best practices”) & more data-driven, expansive recruiting & talent assessment strategies

Compile & share in-depth, up-to-date “best practices” among global peers (i.e. something loosely akin to Vista Equity’s Vista Standard Operating Procedures)

Support the curriculum & content development for a formal sales learning & enablement effort, an internal competency that is largely non-existent today among most Japanese software companies (at least versus what one sees inside more and more U.S. software peers today)

Perhaps getting ahead of our skis here some, but a further, more involved collaboration could be to even co-incubate de-novo software products / businesses alongside portfolio companies, where the “startups” are “spec built” as eventual product bolt-on acquisitions for the portfolio company (refer to my last post on the significant opportunity to incubate B2B SaaS companies in Japan). Realizing that (quality) entrepreneurs & tech talent are the primary bottlenecks to higher velocity startup innovation in Japan today, investee companies can leverage the private equity firm’s expertise & resources (e.x. a development team in Vietnam / India) to offload a meaningful percentage of the execution & management focus to a competent, highly aligned partner, while ultimately reducing the effective purchase price of an eventual acquisition of a key product / business model extension that is already imbued with the portfolio company’s cultural DNA. An exciting win-win for both parties.

Of course, the degree of support one is willing and able to provide will depend on the specific investment strategy employed & internal firm resources available (i.e. AUM, receipt of material non-public information, ownership stake disclosure limits, etc.) in addition to the openness of portfolio company management teams to engage & collaborate. Regardless of the depth of engagement though, there is significant customer, shareholder & stakeholder value still to be created across Japan’s burgeoning software industry. As software company management teams continue to mature on their own as innovative operators & incorporate an increasingly refined, Japan market nuanced set of operational, financial & IR best practices, this emerging value creation will be hard to ignore.

Key Questions To Be Further Explored

While clearly not an exhaustive list, below are two key questions of a larger set that are worth some additional thought & research to more precisely assess the current attractiveness & actionability of the private equity opportunity in Japan’s software industry:

A. The degree to which Japanese banks are willing to lend to software companies & provide debt financing for software company private equity transactions

The short answer…this is unlikely to be much of an issue at this point.

Publicly listed Japanese software companies borrow without any real issues today, while Japanese banks are increasingly lending to unlisted technology startups. One notable example is:

Upsider - the “Brex / Ramp of Japan” has raised a total of ¥10.7B (~$80M) in combined equity & debt. While I don’t believe the company has explicitly revealed who its lenders are, mega-banks Mitsubishi UFJ, Mizuho & SMBC have all invested in Upsider’s equity, so presumably one or more of them have provided debt financing

Anecdotally, conversations with Japanese private equity & venture capital investors have also suggested that banks are generally comfortable lending to software companies across various scenarios and set-ups.

That said, I’ve yet to personally complete any primary research on this topic & do not have any firm confirmation, as it relates to the degree, depth & eagerness of Japanese banks to finance software private equity investments specifically.

Worth briefly highlighting, below is a chart of current SMB lending rates per Japan Finance Corporation. While not exactly indicative of pricing for acquisition financing for software LBOs, the intent here is to more broadly shed light on the very low bank loan interest rates available to Japanese small companies today.

Note: the highlighted 1.25% is the “base interest rate” for a bank loan duration longer than 9 years, though less than 10 years

B. The likely pace with which Japanese software company Founders & management teams - as a whole - come to acknowledge, appreciate & ideally embrace private equity - in all its forms - as a viable liquidity provider and / or growth partner

To reiterate a couple of previously addressed points, a significant reason why private equity in general in Japan has remained relatively underpenetrated as an asset class is due to the historical associations of private equity as “unsympathetic” investors, to put it mildly. This reputation has improved over time, though is probably mostly relevant today when considering buyouts of older software companies founded in the 1980s or 1990s. Among the younger cohort of “more modern” software company company Founders & management teams, I suspect one of the leading, though certainly surmountable, obstacles to the growth of private equity investment in the space is the simple realization on their part that the private equity option even exists alongside a deeper appreciation for its relevant pros and cons. Better illuminating & educating software industry practitioners in Japan about this alternative path to i) financing the growth of a software business (vs. forever bootstrapping, pursuing venture capital or IPO’ing) and / or ii) providing exit liquidity (vs. just an IPO or sale to a most often non-software corporate buyer) should, in and of itself, gradually help to expand the viable “investment TAM” for software private equity in Japan.

In closing…while participating in the growth of the Japanese software industry as a private equity investor would surely be fulfilling & lucrative, the prospects of doing so while building the “Roper of Japan” may be even more compelling over the very long-term.

Said more concretely, effectively partner with Japan’s (hopefully many!) future software private equity firms by acquiring their scaled B2B vertical market software portfolio companies, where revenues are growing organically in the mid- to high-single digits as the #1 or #2 player in their space, enjoying 40%+ EBITDA margins with >80% free cash flow conversion. We may not see as many ~$200M ARR software businesses operating in Japan alone, though there should be plenty of them reaching $50M+ as we push into the 2030s and beyond. We’ll see in time!

As always, I eagerly welcome alternative opinions, disconfirming evidence and, most of all, the willingness of others to further explore this topic & opportunity alongside me! Thank you for reading!