The Globally Unique Opportunity For B2B SaaS Incubations in Japan

An acute tech talent shortage, still very low SaaS adoption, a maturing tech M&A market & few alternatives to "go-go" VC capital currently define the 2nd largest enterprise software market globally

Quick update: Japan Business Insights (“JBI”) is back in business! After a year plus pause due to a long-term consulting project, I plan to publish one to two posts a month moving forward. Topics will range from in-depth business breakdowns of publicly listed Japanese tech companies to interviews of Founders & executives at some of Japan’s most exciting technology startups. Others, like today’s post, will be thought pieces discussing entrepreneurial investing & company building opportunities in Japan. For more of the latter, you can check out some of my older posts from years past:

“Private Equity” Investing With Venture-Like Returns…In Japan

Emerging Market SMB Growth Investing Strategies Applied to Developed Market SMB Buyouts

TLDR for today’s post:

As the 2nd largest enterprise software market globally, Japan today offers an incredibly ripe environment to incubate & launch B2B SaaS startups

Given local market realities, three core incubation strategies are viable and offer different upside potential + risk-reward profiles:

“Aim for the moon”: attack large TAMs, move fast & scale to an IPO;

Build product “bolt-ons” for smaller, more frequent & more rapid M&A exits to increasingly deal hungry domestic tech “giants”; and

“Build & hold” in purposely constrained, largely untapped & non-competed TAMs to become the “Constellation Software of Japan”

Some of the more frustrating (though improving!) “bottlenecks” in the Japanese tech / SaaS ecosystem today are:

The number & quality of entrepreneurs;

The thoughtfulness and quality of execution; and

The lack of alternative (value-added) startup financing options beyond “go-go” venture capital

Of all of the incubation strategies discussed herein, building the “Constellation Software of Japan” arguably offers the highest, most enduring, least competed & thus most attractive long-term risk-adjusted return profile

Powerful Tailwinds Driving The Barely Penetrated, Enormous Market Opportunity

Unappreciated by many is the fact that Japan is the 2nd largest enterprise software market in the world.1 Likely better appreciated by most, however, is that Japan is almost certainly the least “digitized” of the world’s developed economies. This presents a compelling opportunity for both international and Japanese software companies alike to address the fast-growing, still largely unmet demand for modern software applications among Japanese businesses, big and small.

To provide some initial context around Japan’s current SaaS market, I’ll reference the recent Japan SaaS Insights 2022 report published by the SaaS focused Japanese VC firm One Capital.

As noted above, Japan is the world’s 2nd largest enterprise software market

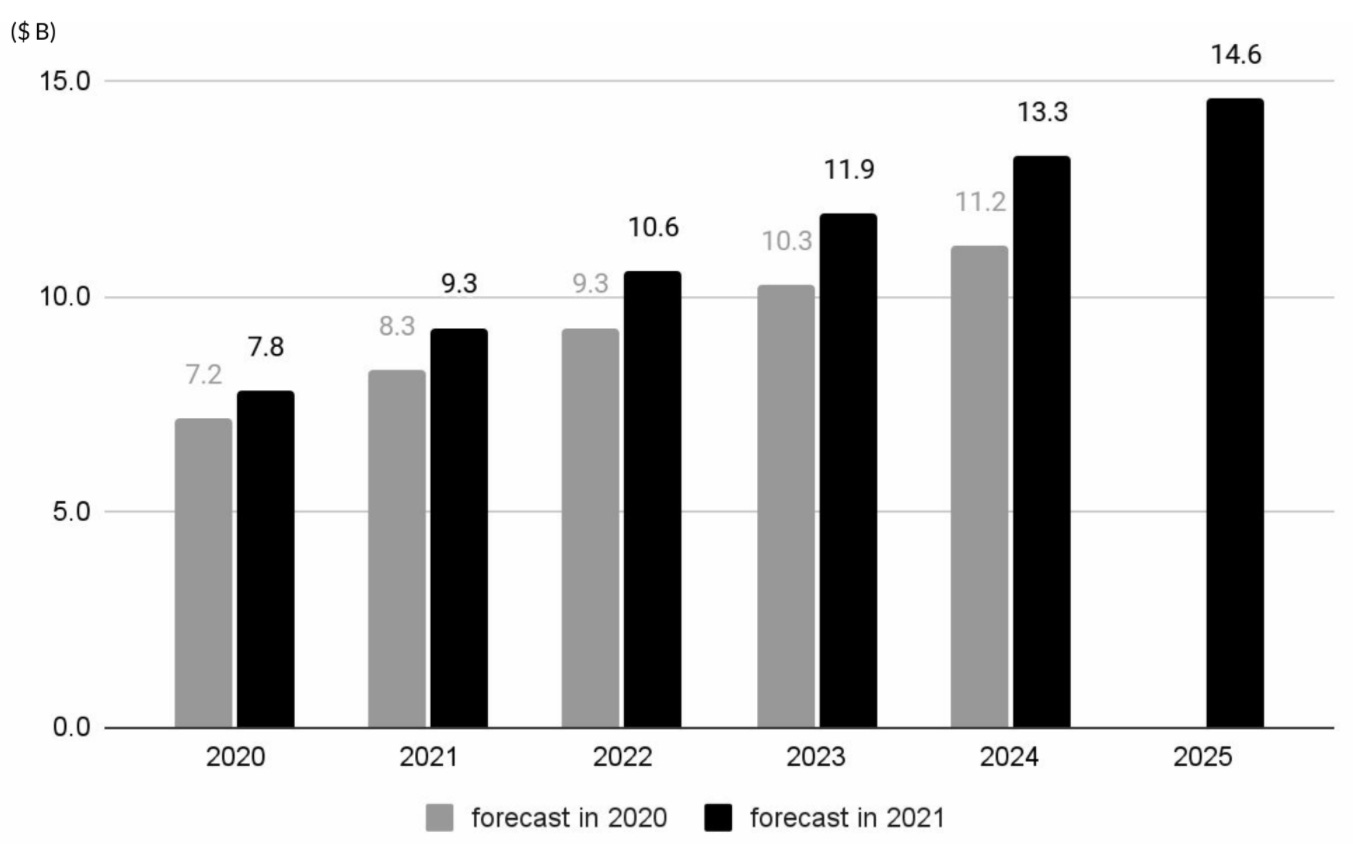

The Japanese SaaS market is expected to be >$10B in 2022 and just shy of $15B in 2025, achieving an 11.3% 3-year growth CAGR

Still a lot of “white space” to penetrate across digital tools & use cases

The aggregate ARR of Japan’s current crop of publicly listed SaaS companies is a mere ~$1.7B…a figure less than Atlassian’s ~$2B of FY21 revenue alone

The number & size of still-private Japanese SaaS companies are growing rapidly

Japan’s vertical market SaaS landscape is still nascent with just ~102 startups

The Japanese Government is also aggressively pushing for the digitization of Japan, while further promoting startup creation. Noteworthy recent examples include:

Establishment of Japan’s Digital Agency, which is headed by the Prime Minister and officially launched in September 2021 with ~600 staff members. The Agency’s primary aim is to accelerate the upgrade & improvement of Japan’s overall “digital infrastructure” & “digital fluency”.

“One of the biggest projects will be GovCloud. Each government agency is now dependent on certain vendors to develop and manage IT systems, including data centers and applications. The Digital Agency will replace this patchwork with cloud computing platforms, such as Amazon Web Services, and let other agencies develop applications on top of this”

Prime Minister Kishida-sama / 岸田首相 recently declared 2022 to be the “First Year of Startup Creation”:

“The key to economic revival and the new capitalism I advocate is the realization of innovation…start-ups, the bearers of innovation, are indispensable for economic growth. This year is the first year for the creation of startups, and we will work to create a startup ecosystem that ranks with the rest of the world.”

Less talked about, but equally exciting (particularly for non-Japanese), is Japan’s Startup Visa program. As the name suggests, the program is focused on increasingly attracting foreign nationals hoping to build startups in Japan. While the specifics are a bit much to cover here, suffice it to say, the barriers of old are coming down and thoughtful progress is being made to promote diversity, growth & innovation.

Relatedly, the Japanese Government is also actively seeking to build Tokyo into a global financial hub. Simplified market entry procedures, relevant tax reforms & relaxed residence status have all been and continue to be be modified in pursuit of this goal.

Lastly, while it is difficult to gather much in the way of “hard” data to support this claim (for now), anecdotal evidence & logical extrapolation of the recent growth of the Japanese tech ecosystem strongly suggests increasingly changing views among Millennials & Gen Z in Japan regarding risk-taking (i.e. one’s perception of risk & thus being more “risk on”…relatively speaking), their careers (i.e. an evolving career working at different companies > lifetime employment) and greater enthusiasm for innovation & experimentation more generally. Now, do realize, however, that this growing subset of younger Japanese adults is still a minority within the broader population. For example, most university graduates in Japan today still prefer to work in the Government given the dependable career stability and societal credibility. Nonetheless, change is afoot & is likely to only further accelerate!

My below response to the question: what’s a (sleeper) trend that gets less attention than it should relative to its potential impact?

Maturing “Exit” Landscape With M&A Accelerating & In Need of Quality Targets

Before diving into the “how” of this incubation concept, it is important to note the current “exit” realities for technology startups in the Japanese market. In short, Japanese technology companies - as a whole - still IPO very early relative to other developed markets. This is slowly changing (see below list of private “unicorns)…

…though an (“early”) IPO still remains the predominate “exit” for most Japanese startups in large part due to:

a relative lack of later stage growth capital (again, increasingly less of an issue);

a limited number of sizable & “dynamic” technology acquirers…to whom Founders are willing to sell;

historical preferences / “requirements” to publicly list in order to help improve credibility among potential customers & prospective talent; and

the sheer ability to publicly list at a very small scale in Japan and to do so rather inexpensively

To give a sense of the median size of the typical IPO in Japan, the below chart shows aggregated data from 2015 to 2020, as compiled by the Japan Exchange Group (operates the Tokyo Stock Exchange). Of note, technology companies generally IPO on the Mothers or JASDAQ. As you can see, the median company listing on the Mothers exchange is effectively a Series B or Series C equivalent startup in the U.S in terms of revenue & valuation. The dollar equivalent amount raised in the median IPO is equal to what a Series A startup is often raising today in the U.S.

With regards to the M&A “exit” opportunity, it is still very much the early days in Japan. As briefly touched upon above, there is an understandable preference among startup Founders to sell to a more “modern” technology company - if they sell at all - versus an “old school” incumbent. Unfortunately, the number of “modern” Japanese technology companies with enough scale, sophistication & resources to be more prolific startup acquirers has simply never been that large of a population to-date, especially within the software space. There’s maybe around a dozen to at most two dozen such tech companies today in Japan - public or private - who fit this characterization (e.x. Mercari, freee, etc.), depending on how exactly you define it.

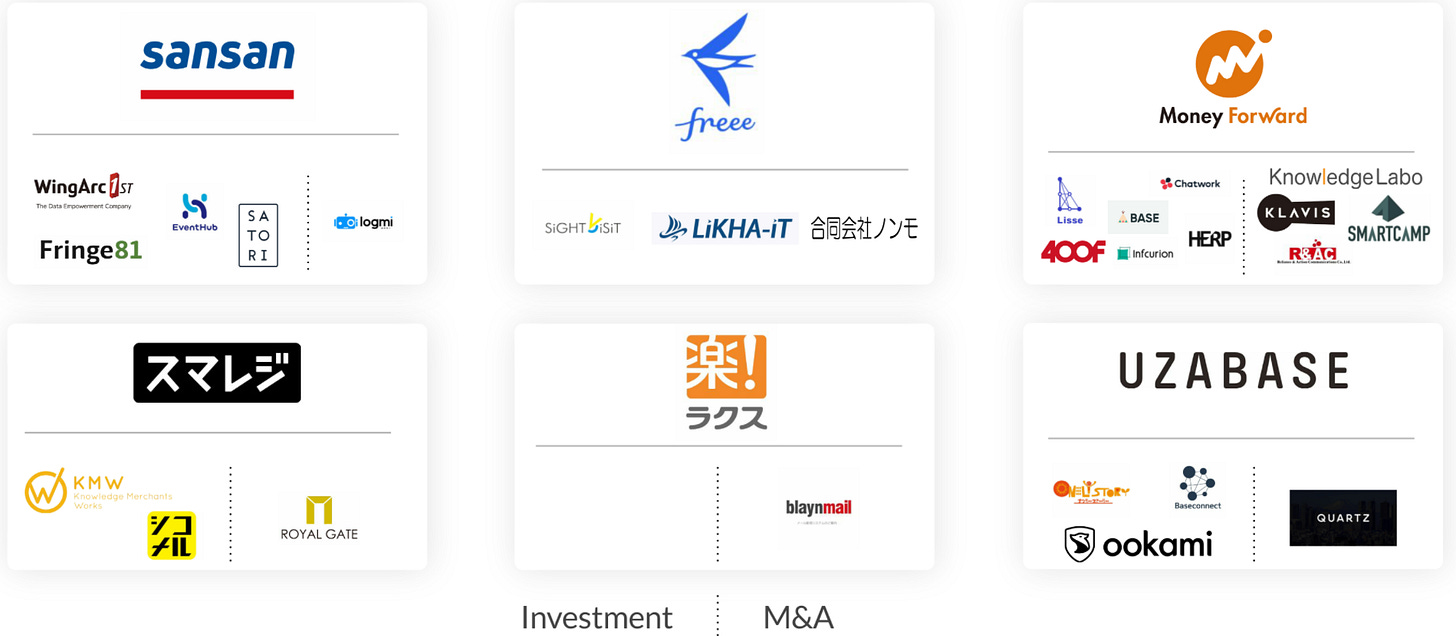

That being said, the acquisition tempo has markedly increased over the last several years, with a number of these larger “modern” technology companies building in-house venture & corporate development teams. HealthTech company Medley (4480) - who is leveraging a dominant, “long-tail” focused, “cash cow” of a digital healthcare job marketplace to fund the development & acquisition of numerous healthcare SaaS products - is a perfect example:

A further example would be freee’s (4478) March 2021 ~¥42B secondary share offering, of which ~¥31B (~$300M, ~74% of the total amount raised) being allocated to “potential acquisitions and investments with the aim of developing new services, enhancing the Company’s existing products and acquiring new customers…”.

Below are two tables which detail a select number of M&A deals in Japan across numerous leading Japanese (& international) technology companies. Notably, most are rather small & effectively product “bolt-ons” / product suite extensions (source: One Capital presentation). Nonetheless, all signs point to an ever more robust M&A environment in the Japanese technology ecosystem.

While a fast-growing appetite for M&A among larger Japanese tech acquirers is exciting to see, there needs to be quality targets available (who are also willing to sell!) for that appetite to be satiated. To be clear, I’m not suggesting that no such potential acquisition targets exist in Japan today, but rather that the “pool” of potential acquisition targets is limited in its breadth, depth, quality & relevance for many of the would-be-acquirers.

Koichi Tsunoda-san, the CFO of Yappli (4168) - which offers low-code / no-code mobile app development & CRM software products - effectively highlighted this challenge alongside a push for greater M&A / investment in a recent tweet:

Clicking through to the M&A Cloud post, Yappli goes on to share the following:

“Would you like to create a new business with Yappli? The seeds of new businesses are greatly needed!”

“We are seeking M&A to build a comprehensive platform to make "digital easier" for our clients. We are looking to partner with companies that offer upstream to downstream services in products such as mobile apps and customer management tools, or in the surrounding areas.”

“Acquisition / investment amount: $500k to $10M”

While referencing CFO Tsunoda-san, I’ll point to another insightful, albeit slightly off-topic, comment he shared in 2021, which indirectly highlights a critical constraint across the entire Japanese technology ecosystem - among both “new school” & “old school” companies. Namely, a severe tech talent shortage:

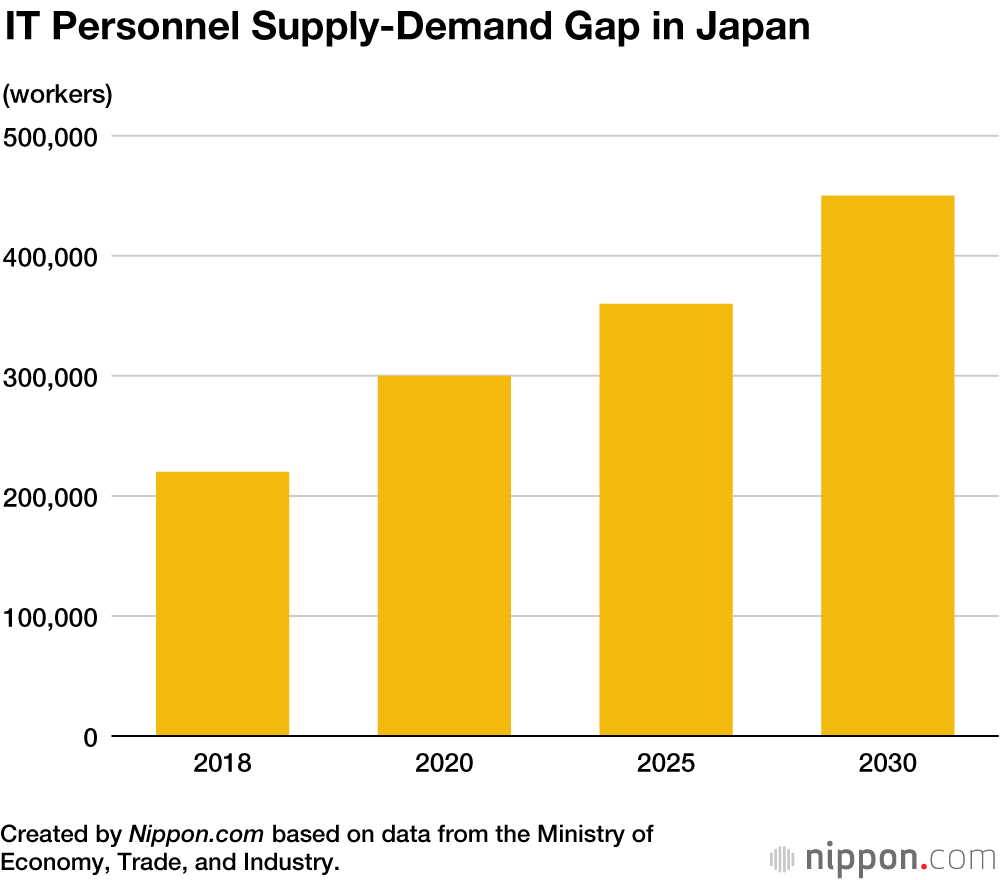

According to Japan’s Ministry of Economy, Trade and Industry, Japan will suffer from a shortfall of ~450k information technology professionals by 2030: “a ‘digital cliff’ looming before the world’s third-largest economy”.

These ~450k IT professionals are presumably included in the overall ~1.5M workers Japan will be sorely lacking across the full economy by 2030. This will require technology & software to “pick up the slack” in a very big way (…particularly if one assumes that Japan does not further loosen its immigration policies…which is a topic for another day!)

A Quick Breather To Summarize & Briefly Expand Upon Some Key Points…

The Japanese enterprise software market is the 2nd largest in the world, with “modern” SaaS applications still barely penetrating the available TAM, both on an absolute & relative global basis

The Japanese IPO market is conducive to very early IPOs, though the post-listing trading reality for tech companies with a market cap of, say, <$500M, can be weak & frankly “dangerous” (i.e. too small for most institutions & thus ends up a “retail stock” that often “traps” the company with shares trading erratically, at oftentimes irrational valuations, while plagued by low liquidity)

Top-tier “modern” Japanese technology companies are growing larger & more sophisticated by the day. The growing ranks of these companies are increasingly looking to M&A to more rapidly & efficiently bolster their product offerings

While certainly improving, the size & quality of the broader Japanese technology ecosystem still lags other global developed market peers (even accounting for population & GDP differences). A logical extension of this “macro” reality is that the pool of early stage startups today - specifically high-quality startups with high-quality underlying products + execution - is lacking relative to what the growing number of “modern” Japanese (& international) technology acquirers would, at the very least, prefer in terms of acquisition targets.

So, we have a very large and still rather untapped market opportunity, an increasing thirst for M&A among a growing number of “modern” Japanese tech companies & too few high-quality startups fitting the fast-evolving preferences & needs of these hungry acquirers…

I think you get where I am going with this…more to come below…

Creatively Building the “Supply” to Match the “Demand” for B2B Software in Japan

There are several ways to go about executing this proposed B2B SaaS incubation strategy in Japan. I’ll try to concisely highlight each below:

Launch an entirely new venture firm in Japan that is primarily, if not exclusively, focused on incubating B2B SaaS startups

One nuanced approach would to be an effective “startup studio”, whereby you would likely want to hire a mix of Japanese & global “operator talent”, with the former more focused on sales & marketing, operations & product in Japan and the latter primarily helping on the development & engineering side of things alongside Japanese colleagues. By the way, this is more or less what several publicly listed Japanese technology companies are increasingly doing (e.x. Cybozu, 4776), particularly in light of the worsening tech talent shortage in Japan

An alternative approach is best encapsulated by the exceptional venture firm Sutter Hill Ventures. There was a great recent Twitter thread discussing the firm & its strategy:

Partner with an existing SaaS focused VC firm in Japan, such as One Capital, and “co-incubate” a few startups in their fund(s).

This is not too dissimilar from Option #1, though it side-steps the whole “de-novo” firm & fund launch process + can leverage the already established VC’s brand, network & capital / “capital reach”.

In both of the above scenarios, one would need to aim for “home-runs” across the entire portfolio, “shooting for the stars” with the hope that one or more of the incubated startups becomes a “unicorn”. I think its fair to say that this approach / these two above options are rather involved in terms of “set-up”, are higher-risk investment strategies in general & run towards competition (i.e. going head-on against other ambitious Founders & increasingly capital loaded VCs) vs. “away”.

Given a personal preference for more “non-competed” market & investment opportunities (you can check out an old post of mine on this broader topic: A “Non-Competed” Investment Blueprint Of An “Esoteric” Investor: Orthogon Partners) + for the purposes of this post, let’s say we “pass” on these two execution paths for now.

Options #3 & #4 are a bit more interesting…though maybe even harder to “stand-up” perhaps:

Partner with an already successful international incubation focused venture firm

Examples would include Expa, atomic.vc or, more ideally, a B2B SaaS focused incubator. There are probably two ways to go about things here:

“Cherry-pick” the best / most relevant B2B SaaS startups in their current portfolio(s) & launch a Japanese entity, presumably by way of a JV type structure (more on this shortly), where the primary focus is on selling & support in Japan (vs. developing the actual product)

Launch “de-novo” B2B SaaS startups from scratch with a Day 1 focus on building for & selling in the U.S. / Europe and / or Japan. Not too different from the immediate above, though can likely be more thoughtful from the start around choosing the “right” vertical / product that best resonates across the combined opportunity sets in the US / EU & Japan

Partner with successful earlier stage (let’s say Series A to Series C) U.S. & European SaaS companies & become their “go-to-market” team in Japan

It’s probably easiest to further describe this strategy by simply discussing the later-stage / public SaaS focused version, Japan Cloud. Japan Cloud exclusively partners with scaled international enterprise software companies and acts as their long-term, “hands-on” Japan market entry consultants. Software company partners include Blackline, Braze, Coupa, New Relic & nCino. Among other activities, Japan Cloud helps recruit & develop each partner company’s Japan Country Manager & other necessary local staff, helps to implement the firm’s proprietary go-to-market “playbook” in Japan & helps facilitate introductions & relationship building with potential Japanese enterprise customers.

Japan Cloud enters into joint-venture relationships with its international software company partners. The below is an excerpt from Braze’s S-1 detailing the specifics of their JV with Japan Cloud:

While the two above options minimize some of the more “heavy-lift” elements of a typical startup incubation playbook (i.e. minimal to no need to build the actual product “in-house”), they are likely be a tough sell to the prospective partners. In both instances, in order to convince a prospective partner to greenlight this opportunity, “we” would need to be able to not only significantly reduce the inherent risk otherwise involved, but also meaningfully increase the speed & size of the potential upside otherwise available. If not, why would a relatively resource-tight Series A SaaS startup, for example, even begin to contemplate launching in Japan when it is presumably barely on its way to conquering its home market?

So, let’s safely assume we “pass” on these two options as well for now.

The Final & “Best” Options: “Doubles For Days” & “Constellation Software of Japan”

“Doubles For Days”

I won’t spend much time discussing this execution path, as it’s rather straightforward & may have been somewhat obvious during the discussion of Japan’s current “exit” landscape. In short:

To expand on this just a bit: build high-quality underlying SaaS products for a rather specific use-case(s), achieve some degree of initial market traction to prove “product-market-fit” & sell the “business” to one of the increasingly M&A hungry, “modern” Japanese tech companies. Ideally, “we” could incubate these “product bolt-ons” directly alongside one or more of these potential acquirers from Day 1. In doing so, the to-be acquirer can be more closely involved in specifying the product(s) to their ultimate preferences, while likely helping to accelerate the development process & reducing their effective purchase price, as they would presumably own a good chunk of the startup from Day 1 as a “co-incubator” vs. none at all or barely any if merely a “seed investor”. The benefits for “us” in this case is that “we” can be more efficient in building, while further de-risking our investment, as we can be quite certain that our “co-incubator” corporate partner will acquire the “business” once we achieve the agreed upon “exit metrics”.

Of course, this could be a bit presumptuous with regards to larger Japanese tech companies’ willingness - let alone ongoing willingness - to partner in such a capacity. But again…there is a very real shortage of (quality) tech talent in Japan today, a growing thirst / need for inorganic growth opportunities among these bigger players & a currently limited pool of quality acquisition targets with Founders also willing to sell to satiate that thirst.

As for the name “Doubles for Days”…well, if this strategy is indeed viable, a “fund” structured around a crack team capable of executing in this capacity is very likely to have a higher slugging percentage than the average venture capital fund. Said another way, this team should be able to aim for & successfully hit numerous “doubles” vs. aiming for & hopefully hitting one or maybe two home runs. Yes, this would likely be a capital-constrained investment strategy, but as noted earlier, I tend to prefer a higher probability, less competed & potentially more replicable return / investment strategy vs. a more “swing for the fences”, highly competed approach defined by extreme power laws.

Building The “Constellation Software of Japan”

Perhaps not widely known, but Constellation Software has been active in Japan for years. The company has a small, full-time team based in Tokyo, who is apparently in regular contact with THE man himself, Mark Leonard, Founder, President & Chairman of Constellation Software.

Unfortunately, Constellation has struggled, it appears, to acquire Japanese vertical market software companies. Having spent a good chunk of the last several years myself exploring the vertical market software acquisition opportunity in Japan, I suspect Constellation has run into the following three core problems:

Software more generally in Japan hasn’t been widely used by many of the country’s SMBs in the past. Point being, and certainly relative to, say, the U.S., there just aren’t that many software companies in Japan, as there hasn’t really been much demand for software historically. Paper & pencils have reigned over Japan for decades…and still do in many ways today!

Vertical market software companies - as those in the U.S. & Europe have come to define them when studying the likes of Constellation and Vitec Software - are simply not as common in Japan. The more common, closest equivalents in Japan are effectively one-off development shops, who tend to build & maintain highly customized software of various types for a variety of clients oftentimes across industries.

While slowly changing, the idea of selling one’s small business in Japan is not itself a common thought / desire…yet. Even less common is the thought / desire of selling one’s business to a foreign corporation. Selling a small business in Japan is very closely linked to effectively handing off to the buyer one’s decades-earned reputation among & personal relationships with an array of stakeholders. Of course, this is a generally similar reality elsewhere around the world, but the importance placed on such matters by Japanese small business owners is usually far greater than one would see among, say, American SMB owners, where selling a business is arguably viewed more heavily as an important “financial transaction” for the owner. On top of this, seller expectations in Japan today - particularly in the software space - can often be irrational. More specifically, software SMB owners will frequently tie their valuation expectations to the valuations of much larger and far higher-quality publicly listed software companies, like freee or Sansan.

In short, in the rare event that you are able to come upon a quality VMS acquisition target in Japan, there’s a high likelihood that the seller just simply won’t sell - particularly to a foreign corporation - or will only sell at a price which makes the acquisition effectively impossible.

So, given the above, what do we do?

We build the “Constellation Software of Japan”. We seed a “startup studio” - and subsequently raise a Series A, a Series B & so on until it can adequately self-fund via internal free cash flow and / or third-party bank debt - that itself is a holding company with a multi-decade time horizon. We target the “unsexy”, “constrained” TAMs (e.x. marinas, libraries, justice systems, non-profits, utilities, etc.) passed over by most entrepreneurs & VCs. We grow more slowly in a capital-efficient manner, in large part because we can in our “boring”, “small” TAMs, where we face few, if any, similarly competent & “modern” competitors in Japan. Given our slower pace, we can work more closely with prospective & existing customers to truly “spec-build” for their unique use cases, likely lowering our CAC & maximizing our LTV over time, while allowing for actual free cash flow earlier than otherwise. We should face fewer constraints in recruiting, as we don’t need the “cream of the crop” engineers or product designers, as the “category velocity” of our portfolio companies will most often be “low”…

…I think you get the point.

At least to my knowledge, there is no coordinated, focused group executing - let alone contemplating - this strategy in Japan today. Most young Japanese tech entrepreneurs these days are enamored by the siren song of the fast-expanding ranks of Japanese VCs, who extoll the virtues of high growth, scalability & achieving coveted “unicorn” status.

Note: I have nothing against VCs whatsoever! They play a critical role in the tech ecosystem & their business model inherently requires investing in “shoot-for-the-moon” startups to achieve outlier returns. Rather, the point I am trying to make is that not every startup should take on venture capital funding. As we have seen time & again, VC funding in certain (“lower velocity”) verticals & opportunity sets - at least when overly abundant - can actually be downright destructive over time. Wonderful businesses (& careers!) can be built without chasing the statistically low probability dream of becoming a (capital-hungry) “unicorn”.

Said another way, I suspect that most prospective Japanese tech entrepreneurs today are of the belief that in order to build a startup, it’s the VC way or no way. And frankly, they may be correct in that thinking. There just aren’t many other - if any really - alternative forms of risk-capital nor startup company building strategies truly active in Japan today.

As a result, I’m of the present view that “if you build it (and remember, we “have to”, given that acquiring VMS is less than likely in Japan!), they will come”. Once aware that such an opportunity exists (i.e. building the “Constellation Software of Japan” as outlined above), is viable & can be both quite stable (which is a very important career consideration for most Japanese professionals & is not the case for most startups) and extremely rewarding for all involved (intrinsically & financially over time)…the Founders with whom we’d incubate these VMS, the customers with whom we’d partner to build these valuable products, the broader teams tasked with helping to prudently grow & sustain these companies, along with many other stakeholders…they will all gradually come together to help build a durable, cash flowing, software “compounder” that even Mark Leonard himself may applaud!

There is certainly much more that can & should be discussed with regards to the above. However, this post is already too long (as usual) and, more importantly, I hope to continue this discussion - and others like it - via more lively dialogues with those who are kindly reading this. So, please do reach out. I’d love to swap notes, further brainstorm & perhaps even explore ways to bring one these visions to life. Thanks so much for reading!