Japanese Software Industry: Current Perspectives & Observations

Including a brief overview of an increasingly Enterprise focused micro-cap software company with a catalyst-driven, highly asymmetric upside through August 2026

It has been awhile, but I am back to writing…at least this one post! What’s shared below is a little different from those I’ve written in the past. More specifically, I discuss some current - and always subject to change - perspectives on the Japanese software space, as well as share a brief overview of a compelling and somewhat timely Japanese public software investment opportunity.

Also, a quick personal update: I am now officially living in Tokyo! Should you find yourself here, please don’t hesitate to reach out. I am more than happy to meet up in-person to share & learn more. You can find me on Twitter or via email at will [at] goldsoutheast.com.

Current Observations & Perspectives on the Japanese Software Space

While the below may seemingly tilt a bit more negative on the surface, it is worth re-emphasizing that I remain very long-term bullish on the Japanese software industry & its prospects moving forward. One important caveat, however, is that my optimistic views tend to lean more heavily towards those companies building more capital-efficient, slower-growing (i.e. 20% to 30% YoY) businesses targeting generally more domestic oriented markets…for now. I also welcome pushback from those with alternative views & supporting data! With that said & in no particular order…

Largely due to cultural (i.e. consensus decision making, etc.), regulatory (i.e. labor laws, wage levels) & deep-seated industry practices / realities (i.e. power of SI’ers & resellers), Japan is a better market to invest behind and / or build relatively slower growing software companies - even at the earliest of stages - who can often achieve profitably far earlier in their lifecycles vs. elsewhere globally

In the U.S., the median LTM revenue of software companies at IPO over the last several years was ~$183m, growing 55% YoY. I haven’t compiled similar data for Japan, though I’d be shocked if the median YoY growth rate for Japanese software companies at IPO over the same time period was even close to that level with, at best, maybe $30M in median revenue. Importantly, I don’t believe this sizable gap, specifically with regards to YoY growth rates, is due at all to Japan’s overall smaller market size vs. the U.S. nor its software market lagging behind that of the U.S. in terms of its maturity…rather, talent constraints, sophistication of execution & cultural norms / common practices among software buyers are likely some of the primary contributing factors

Far more than I suspect most outside of Japan realize, there are many existing companies - oftentimes not at all “pure-play” software businesses - who are building internal SaaS products / companies in cooperation with “sister” companies, other industry players, System Integrators and / or Resellers

Some of these “hidden” software companies have very impressive early metrics, in large part due to their ability to leverage the existing distribution & industry know-how of their “partners”. This offers up a double-edged sword of sorts, whereby these companies are likely otherwise very difficult to similarly build as independent entities, but are also effectively woefully undervalued “trapped” inside their generally non-software parent companies. I suspect (or perhaps I should say hope) that over time these parent company management teams will smartly spin-out these “incubated” software companies once meaningful scale & sophistication has been achieved (i.e. hello “friendly activists”…)

While “modern”, scalable SaaS products are indeed penetrating the Enterprise market - Oracle & Salesforce enjoy >¥200B in revenue, while the likes of Japan Cloud is successfully bringing scaled U.S. software businesses into Japan - much of the software used in the Enterprise market today remains customized or packaged (i.e. ~90%). There is ample opportunity for modern SaaS businesses to further penetrate this market, though it may still often require the sales support of SI’ers & Resellers, which will have an impact - both positively & negatively - on subsequent unit economics

Product-led-growth (“PLG”) strategies are less effective in Japan

Generally speaking, software procurement processes are more centralized, often times constrained by strict budgets & vested interests. Said another way, a great new freemium product available to individual contributors who can just “swipe a credit card” to upgrade is the exception rather than the norm today across the full spectrum of company sizes

Additionally, the level of employee tech fluency in most organizations - big & small - is arguably meaningfully lower vs. U.S. peers, with a lot of technology purchase decisions, again in both big & small companies, either semi- or fully outsourced to consultants or System Integrator groups

Too many younger software companies are attempting to become “compound startups” (i.e. multi-product) far too early

This can be “unhealthy”, if not downright risky, particularly in “lower velocity” verticals. The rapid headcount growth - which cannot be easily cut in Japan - coupled with quasi-half-baked products bloating product portfolios that further complicates a still likely immature go-to-market capability within a customer base that has yet to fully capture the value-add (& wide-spread trust) of the initial, core product…you get the picture…

Particularly so in Japan, far fewer early-stage software companies should raise venture capital (i.e. many more should “bootstrap” and / or tap lower-cost-of-capital funding sources)

Generally speaking, most software entrepreneurs in Japan feel raising VC capital is really the only way (& is arguably deemed to be a sign of “success”); it may just be a matter of time & “education”, in part by observing the growing success of companies such as Codmon, for a bootstrapped building mindset to gradually blossom among software entrepreneurs

This is particularly relevant among vertically focused software companies, where the end-market “velocity” is relatively slow (and arguably even slower in Japan vs. the same verticals in the U.S.) and the “TAMs” are meaningfully capped (i.e. generally less competition, all things considered)

Lower cost, alternative forms, of value-add risk capital need to grow in size & availability; however, these capital providers will compete with the growing amount of generally attractive & plentiful venture & bank debt being provided to “growth companies” in Japan today

Private equity acquisitions of software companies will explode during the latter half of this decade. This has already started to happen with KKR’s acquisition of Yayoi & EQT’s recent acquisition of HRBrain, for example

One or more private equity firms dedicated to software will likely launch during this time as well. These funds will most likely be necessarily small, say, $100M to $500M in AUM to begin

More interesting to me personally at that time, however, will be the opportunity to launch a “bootstrapped” focused software investment firm, such as Mainsail Partners in the U.S., or perhaps better yet, a smaller-scale “Roper of Japan”

What works in the U.S. market - pretty much across the spectrum of business building strategies & execution best practices - isn’t always very applicable in Japan

While I don’t think the below former view is so much the case anymore (i.e. there is indeed more than enough later-stage private growth capital floating around); nonetheless, the reason why there is “no later-stage growth capital” in Japan has less to do with an absence of later-stage growth investors active in Japan & is more so due to there just still being very few quality private later-stage software companies in existence in Japan

While gradually improving, the entrepreneur quality in Japan has a ways to go to match global peers, with an even greater dearth today of dynamic, high-quality executive-level talent to surround these founders

This is in part due to most Japanese entrepreneurs still being first-time founders & quite young / inexperienced when launching their companies. Largely due to cultural reasons, far fewer mid-career professionals in Japan are willing to “take the leap” to start companies (fortunately, this is increasingly less so the case in terms of joining established startups), which is not the case in the U.S., where these more experienced, mid-career professionals are often the better founders, all things considered

While I sincerely hope that Japanese software companies can better scale & compete globally over time - and am eager to support those companies aiming to do so (!) - I am less inclined today to personally invest behind companies pursuing such aims for a variety of reasons, ranging from limited access to and / or “capability” to pay for (high-quality) global talent, the existence of strong + well-funded local competition in most other attractive global markets & still few experienced Japanese founders / executives able to “recycle” successful global expansion experiences into their current companies, among other reasons

It is not possible today to acquire ones way to building the Constellation Software of Japan, at least to any meaningful degree of scale (note: Constellation can’t even do it here), nor are Constellation’s broader strategies around “cost containment” & price increases anywhere near as viable

While admittedly imprecise, I’d optimistically peg the number of “CSU-esque” vertical market software companies (i.e. a software vendor in business for 5+ years selling a non-customized offering across numerous customers) in Japan at maybe 1/50th the size of CSU’s apparent ~45k or so potential targets in its North American deal tracker

Speaking solely of VC-backed “modern SaaS” vertical market software companies, there is only about 100 to 150 in existence today

This broader acquisition opportunity may be more viable later this decade & beyond when there are presumably more small-scale, “busted” VC-backed SaaS companies needing a home. However, in the meantime, incubating the Constellation Software of Japan is likely far more viable & attractive on multiple levels, though is also unlikely to reach anywhere near the relative scale of CSU today

Leveraging fast-expanding teams at “off-shore”, company-owned development centers in Vietnam, India & so on is increasingly the norm among not just software, but most all larger, “modern” Japanese tech companies. Publicly listed Japanese tech companies with such overseas engineering teams include Raksul, MoneyForward, Cybozu & Mercari, among others

This broadening reality presents a potentially interesting opportunity for the likes of Trilogy Software in Japan, specifically with regards to their “streamlining” strategy / approach to managing (acquired) software companies

A continued challenge for most younger software companies is the quality & scalability of their internal sales capabilities

While the ability to conduct direct sales within the Enterprise space is improving, the role of System Integrators & various types of Resellers remains significant, if not essential, in supporting the growth of many Enterprise focused, younger software companies

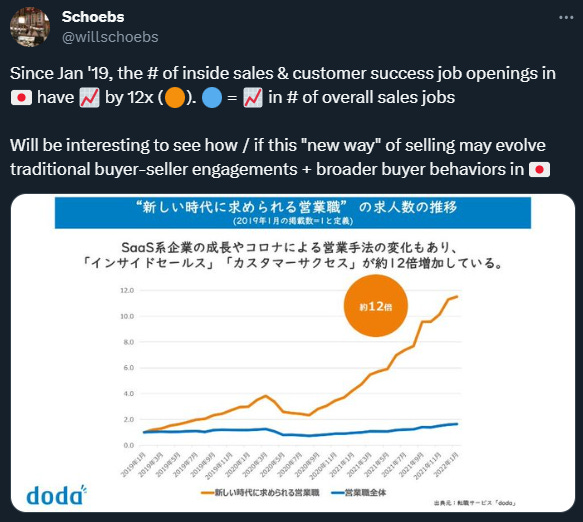

Inside sales for modern software has only recently become more of “a thing”

83% of those working in B2B sales feel "unwilling to do it” or “wanting to take time off". Yes, this could be somewhat similar in the U.S., though it is worth noting the case-by-case reality that Account Executives are not always provided with commission bonuses in Japan & there still remains relatively few deeply experienced in selling modern software. Moreover, the sales cycles in Japan are generally meaningfully longer than those in the U.S., requiring more work & less “realized success” among AEs in a given timeframe

While perhaps relevant for all global software markets, and also hard to quantify, I suspect most investors are not yet giving enough thought / credit to the potentially significant relative improvements to sales cycles, adoption curves, efficiency gains in customer success & so on in Japan, specifically as a result of the “generational changing of the guard” inside Japan Inc. & how that could positively alter the software buying / implementation / support process over the medium- & long-term

I am speculating some here & haven’t thought deeply enough on this topic, but advances in AI may actually serve to further entrench the powerful System Integrators in Japan (i.e. why endure the rough process of switching to a lower cost, “modern” SaaS offering when my existing customized software can now be more efficiently maintained / upgraded at a lower cost by fewer AI-assisted developers?)…if they can adequately harness the productivity gains from tools like CoPilot & the like

Over the course of my ~8 years following & investing in primarily publicly listed Japanese software companies, the level of sophistication & execution quality among management teams - at least among the leading software companies - has meaningfully accelerated over the last ~3 years

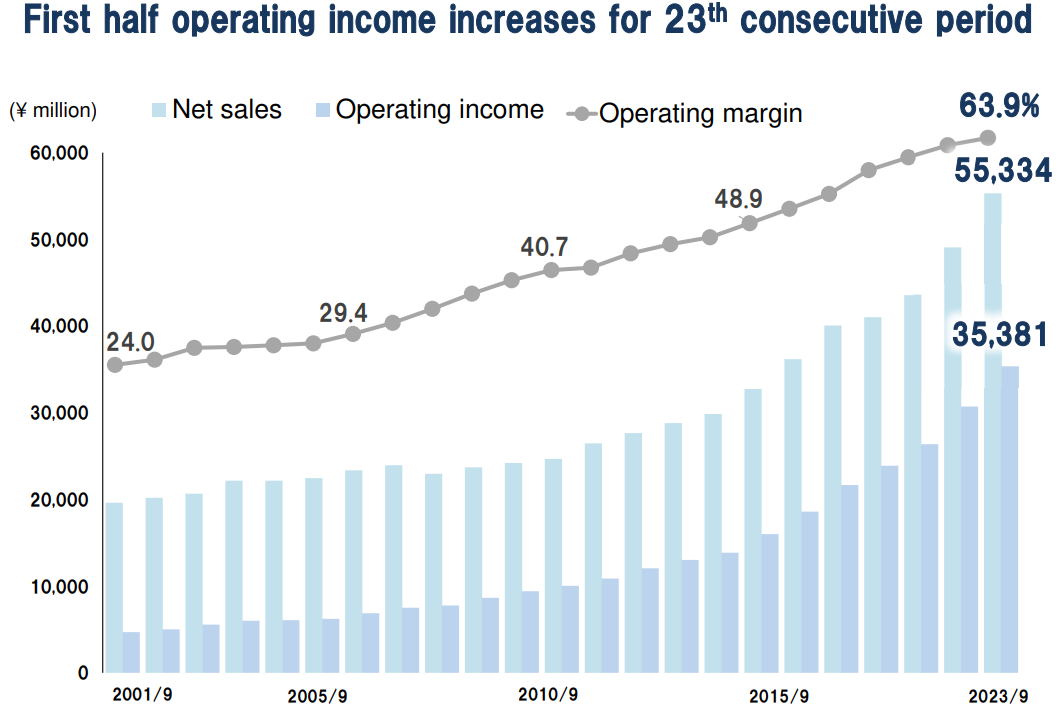

While few will ever achieve this degree of scale & success in the Enterprise space, OBIC (4684) is living proof of what is possible when selling a very “sticky” solution to Japanese Enterprise customers:

New Leadership Set To Accelerate Profitable Scaling Into the Enterprise

Given its market cap, this investment opportunity is unlikely to be viable for a number of readers of this post, at least professionally. However, it is a perfect example of the type of investment for a particular kind of fund that I feel should exist in Japan & that I would like to, at some point, explore launching in Japan. More specifically, an AUM-capped, technology / software focused fund in the broader image of a Browning West or Advantage Partners Private Solutions. The fund would maintain a concentrated portfolio (i.e. 5-7 stocks), where the team would closely support investee company CEOs, CFOs & Boards over, ideally, a 3 to 7+ year time horizon.

TeamSpirit (4397; ~¥3.2B Enterprise Value)

Business Overview:

Provides an “employee success” software offering with current modules supporting attendance management, employee management, internal communication & expense approval + reporting

“Back-of-the-Envelope” Targeted Outcome by the end of FY26 (August 2026):

Potential 3x to 6x+ MOIC from the current valuation

A gradual multiple re-rating from ~1x ARR today to >3x ARR (>20x EBIT) due to:

Acceleration of ARR to >20% YoY, primarily within the Enterprise segment

Inflection to profitability from an EBIT margin of <0% today to >10%

Anticipate ARR re-acceleration & move to profitability to increasingly show up in quarterly numbers beginning in 2H FY24 (i.e. March to August 2024), though will predominately play out during FY25 & FY26

Given this likely timing & without a more informed perspective based upon discussions with management, one could argue a “wait-and-see” approach is warranted at the moment before locking up capital in this opportunity. Missing the initial 50% to 100% upside in the stock may be worth the incremental de-risking of this thesis that ideally occurs during FY24

Why Interesting:

If management’s mid-term projections are to be believed, TeamSpirit will ~2x its ARR in ~36 months (by August 2026), while achieving ~¥1B in EBIT at that time. At its current enterprise value, the stock presently trades at:

~0.5x EV / Aug '26E ARR

~3.0x EV / Aug '26E EBIT

Historically focused on SMBs, TeamSpirit has more recently turned its attention to the Enterprise, in which it has exhibited compelling initial traction to-date & around which the company is now re-tooling its entire product & sales strategy. Relevant statistics & efforts include:

# of Enterprise licenses increased by 69% between FY21 to FY23, representing ~33% of total licenses in FY21 to ~40% in FY23

On an ARR basis, the Enterprise sales pipeline is up 2.6x vs. the start of FY23

Doubled YoY the number of Account Executives focused on Enterprise

Increasing go-to-market collaboration with ERP vendors & consulting firms

A new CEO was announced on November 27, 2023, replacing the long-time Founder, who brings a wealth of relevant experience & insights to further power TeamSpirit’s push into the Enterprise

On the surface, a Founder stepping back may invite some cause for concern (note: the Founder has been CEO since the company’s founding in 1996, so it is arguably well worth bringing in fresh leadership at this point); however, the new CEO brings significant enterprise software sales experience having been the General Manager of the CRM/HCM division at Oracle Japan, the lead for Product Sales at Salesforce Japan & the Japan Country Lead for WalkMe (in association with the estimable Japan Cloud). Additionally, Michishita-san is in the prime of his career at 49 years old & is meaningfully intimate with TeamSpirit in light of his role as an advisor to the company since December 2022 (i.e. he presumably “likes what he sees” to have accepted an offer to become CEO)

The company launched a renewed product line-up & pricing model in September 2023 to presumably allow for increased price discrimination & easier customer “lands” within the Enterprise segment. These “lands” can later be up- & cross-sold, driving increasing ARPU & revenue over time + improved gross retention (up from ~94% today)

Key Risks:

Management projections are too optimistic and / or execution falls below expectations

The broader software HCM space in Japan is already very crowded, with a host of scaled public & private players active in or recently entering the market (i.e. Visional, SmartHR, OBIC Business Consultants, etc.)

Mitigant: TeamSpirit has a proven, existing product in-market - albeit historically more attuned to the SMB space - and has already shown notable traction in its initial efforts to sell into the Enterprise market (e.x. below image depicts # of licenses). Additionally, the broader SaaS HCM opportunity in Japan remains deeply underpenetrated (i.e. at just ~10% of the overall enterprise “frontware” software market), so a “rising tide can still lift all boats”

TeamSpirit is a micro-cap company (~¥3.2B enterprise value) & is likely too small / illiquid for most institutional investors. This could limit the ability of the stock to “fully re-rate”, even if execution is on-point. Relatedly, such a re-rating may come later than otherwise hoped or expected, or potentially not at all

Mitigant: while probably not an optimal outcome for public shareholders, with the likely accelerated growth in software focused private equity in Japan over the coming years, coupled with the new CEO’s experience, sophistication & industry reputation + network, there is more likely than not a “private-equity put” in play here that is (hopefully) significantly above today’s current share price. That said, such “private equity puts” are not something an investor should generally rely on

Further Due Diligence Required:

More fully vet the quality & perspectives of the new CEO (i.e. reference checks)

A more fulsome assessment of the competitive landscape in the HCM space

Conduct (the rather difficult to do in Japan) customer / expert calls about TeamSpirit’s products, support & so on

Thanks for reading!

Hi Will Schoebs, you are mega bull on Sansan. Looking at the 3 sw suites, esp. the highly profitable Sansan at 50% mgns, it seems they just sell point solutions? How defensible are their sw suites? It seems like something which could be uprooted by a bigger player.

Thank you for this article. Do you know Future Corp and have an opinion? I like the figures, but cannot value the quality of the IT Service.